NetSuite SOX Compliance: Secure Your 2025 Audit

Why NetSuite SOX Compliance Matters for Your Peace of Mind

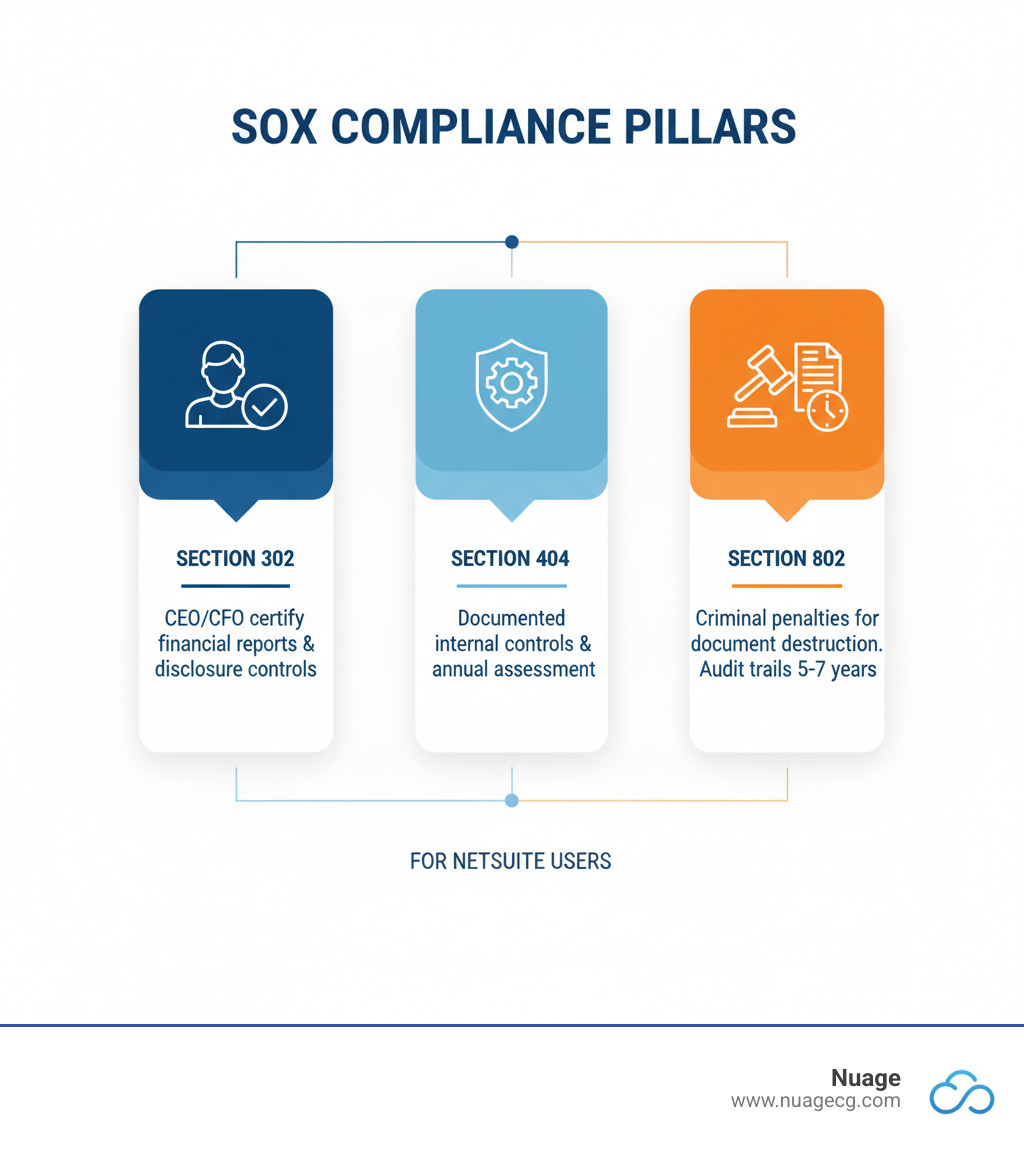

NetSuite SOX compliance helps companies meet the strict financial reporting and internal control requirements of the Sarbanes-Oxley Act through built-in governance, risk, and compliance features. To establish effective controls, you need to focus on:

- Access Controls – Role-based permissions and segregation of duties (SoD) across 636 distinct permissions.

- Audit Trails – Immutable system notes tracking all configuration, transaction, and data changes.

- Change Management – Documented processes for scripts, workflows, and customizations.

- Financial Controls – Approval workflows, field-level security, and automated validation.

- Reporting – Saved searches and reports demonstrating ongoing compliance every 90 days.

Born from the 2002 accounting scandals of Enron and Worldcom, the Sarbanes-Oxley Act (SOX) mandates that all US public companies, their subsidiaries, and those aspiring to go public ensure financial data integrity and executive accountability.

NetSuite’s cloud ERP platform provides a strong foundation for SOX compliance, backed by externally audited SOC 1 Type 2, SOC 2 Type 2, and ISO 27001 certifications. The system’s robust internal controls, automated workflows, and comprehensive audit trails are designed to protect financial data.

However, owning NetSuite doesn’t guarantee compliance—the challenge lies in configuration and usage. Many companies struggle to manage NetSuite’s vast permission structure, track customizations that impact financial processes, and maintain audit-ready documentation. They know the tools exist but are unsure how to implement them effectively.

I’m Louis Balla, and I’ve spent over 15 years helping companies optimize their NetSuite SOX compliance. At Nuage, we specialize in bridging the gap between NetSuite’s potential and how companies actually use it, helping businesses tap into more than just the 20% of the platform’s capabilities they typically use.

The Foundation: How NetSuite Natively Supports SOX Compliance

NetSuite is built with security and governance at its core, making your path to NetSuite SOX compliance significantly smoother than with legacy systems.

The platform’s cloud infrastructure means Oracle handles the heavy lifting of infrastructure security, maintaining rigorous external certifications like SOC 1 Type 2, SOC 2 Type 2, and ISO 27001. This shared responsibility model allows your team to focus on configuring application-level controls specific to your business needs, rather than managing data centers and network security.

NetSuite’s built-in financial controls and automated processes are core features, not optional add-ons. When configured properly during your NetSuite ERP implementation, these tools form a natural defense against the data integrity issues SOX was designed to prevent. You can learn more about how these controls work in our guide to NetSuite Finance Modules.

Understanding NetSuite’s GRC Framework

NetSuite’s Governance, Risk, and Compliance (GRC) framework is fundamental to the platform, addressing key challenges for financial leaders. Oracle designed NetSuite’s GRC capabilities to provide:

- Governance: A single source of truth created by centralizing all financial transactions, approvals, and changes. This eliminates spreadsheet chaos and provides immediate, reliable answers for auditors.

- Risk Management: Proactive risk management is enabled through automated workflows and alerts. Saved searches can flag unusual transactions or patterns, helping you catch errors or potential fraud early. Our NetSuite Financial Planning services help build these monitoring capabilities.

- Compliance: The platform automatically generates comprehensive audit trails for every login, transaction, and configuration change. It also supports various global electronic audit file formats (SAF-T, GDPdU, IAF), which is crucial for international companies.

This integrated GRC approach means you aren’t juggling separate systems to prove your controls are effective for NetSuite SOX compliance.

Key Native Features for Data Integrity

NetSuite provides layered security features to ensure only the right people can access specific data, leaving a traceable record of every interaction.

- Role-Based Security: With 636 distinct permissions, you can create granular roles that limit user access to only what’s necessary for their job, reducing the risk of errors and fraud.

- Approval Workflows: Route sensitive transactions like journal entries or purchase orders through multi-level approval chains, creating an automatic audit trail of who reviewed and approved each step.

- Field-Level Security: Hide or restrict specific fields within records (like credit card details or cost data) for precise data access control.

- Multi-Factor Authentication (MFA): This crucial second layer of security prevents unauthorized access even if a user’s password is compromised. We recommend enabling MFA for all users.

- IP Address Restrictions: Limit system access to approved locations, such as your office network or VPN, adding a geographic barrier against external threats.

Even companies using NetSuite for Small Business should configure these features from day one. This “defense in depth” strategy is exactly what auditors look for when evaluating your NetSuite SOX compliance posture. For help optimizing your entire NetSuite ERP environment, we’re here to help.

Building Your Fortress: Core Components of NetSuite SOX Compliance

Think of NetSuite SOX compliance as building and maintaining a fortress around your financial data. The goal is to prevent data tampering, ensure data security, and create clear accountability by weaving internal controls into your daily operations. Building these controls into your NetSuite ERP Implementation from the start will save you countless headaches.

Mastering Access Controls and Segregation of Duties (SoD)

Segregation of Duties (SoD) is a core SOX principle: no single person should control a financial transaction from start to finish. In NetSuite, with its 636 distinct permissions governing 4,923 tasks, managing SoD can be complex.

- Define Roles Clearly: Grant access based on what each person needs to do their job. Avoid the temptation to grant extra access “just in case,” as this is where SoD conflicts arise. For example, a user who creates vendors shouldn’t also approve payments to them.

- Use Standard Roles as a Foundation: Start with NetSuite’s pre-built roles and customize only when necessary to minimize complexity.

- Identify and Mitigate Conflicts: Manually identifying SoD conflicts is nearly impossible. Use specialized tools or expert help to find them. For unavoidable conflicts (common in small teams), implement compensating controls, such as mandatory manager reviews or dual approvals.

- Review Permissions Regularly: As your business and team evolve, so should your permissions. Regular reviews are critical. NetSuite’s guide on Controlling Access to Your NetSuite Data can help. For more guidance, see our NetSuite Implementation Best Practices.

Maintaining Immutable Audit Trails

NetSuite’s built-in, tamper-resistant audit trails are a key asset for SOX compliance.

- System Notes: This feature acts as an always-on recorder, capturing the who, what, and when of all configuration changes, administrative actions, and master data modifications.

- Transaction Numbering: NetSuite automatically sequences all GL-impacting transactions, ensuring nothing can be deleted or altered without leaving a trace.

- Login and Configuration Audits: The system tracks every login attempt (successful or not) and logs all changes to system settings, roles, and permissions, providing a complete history for auditors.

While native system notes are excellent for tracking most changes, they lack detailed insight into code-level modifications within scripts and workflows. This is a common reason companies seek third-party tools to supplement their NetSuite Data Analytics and compliance efforts.

Best Practices for Change Management and NetSuite SOX Compliance

Auditors require proof that every system change, especially those affecting financial reporting, follows a controlled and documented process. This is critical when managing NetSuite ERP Customization.

- Document Everything: Link every change to a business requirement, noting who made the change and why.

- Analyze Impact: Before deploying a change, understand its downstream effects on fields, workflows, and saved searches. This is difficult with native tools but crucial for preventing unintended consequences.

- Establish Clear Policies: All modifications should follow a structured process: submission, review, approval, testing, and deployment. No shortcuts.

- Test in Sandbox First: Never deploy changes directly to production. Use NetSuite’s sandbox environments to thoroughly test all customizations and integrations before they go live.

Navigating the Maze: Customizations and Advanced Tools

The very customizations that make NetSuite so powerful—SuiteScripts, workflows, and custom fields—can become your biggest compliance headaches if not managed properly. The flexibility that drives growth can create audit blind spots.

At Nuage, we help clients ensure their business-critical customizations don’t become compliance liabilities. Whether you’re managing complex NetSuite Integration Services or building sophisticated workflows, visibility and control are paramount.

The Impact of Customizations on SOX Compliance

Auditors focus heavily on customizations because they can alter how NetSuite processes financial data.

- SuiteScripts and Workflows: Custom code can change financial calculations or transaction processing. A key challenge is that NetSuite’s native system notes show that a script was changed, but not what changed within the code. This makes demonstrating proper change control difficult.

- Custom Fields and Records: A seemingly innocent custom field can have SOX implications if it feeds into financial calculations. Auditors will want to know who can create and modify these fields and whether they impact financial reports.

- Bundles: Modifiable (“opened”) bundles of customizations transfer the responsibility for change management to you. Many companies overlook this until an audit.

As one compliance expert noted, with NetSuite’s native tools, “it’s difficult to know the full effects of a change before you try it.” This uncertainty is a red flag for auditors. You must document every customization: what it does, why it exists, who approved it, and how it was tested. For practical advice, the Three Steps to NetSuite SOX Compliance guide is a useful resource.

Enhancing Compliance with Third-Party Solutions

While NetSuite’s native features provide a strong foundation, companies with complex customizations or strict audit requirements often turn to third-party solutions to fill specific compliance gaps.

These specialized tools provide:

- Automated SoD Analysis: Instead of manually checking for conflicts among 636 permissions, these tools use pre-built, auditor-approved rulesets to identify risks in minutes.

- Advanced Change Management: Solutions like Salto and Netwrix Strongpoint offer line-by-line comparisons for script and workflow changes, providing the granular visibility auditors require. They also track dependencies to help you understand the full impact of a change.

- Impact Analysis: Simulate changes before deployment to see which users, transactions, or reports will be affected, preventing costly errors.

- Cross-Environment Visibility: Compare your production and sandbox environments to ensure a controlled, documented deployment process.

- “Closed-Loop” Change Management: Integrate with ticketing systems like Jira to link every system change to an approved request, creating an airtight audit trail.

- Risk Quantification: Some tools can analyze the actual financial exposure of an SoD conflict, helping you prioritize remediation based on real-world risk.

The decision to invest in these tools depends on your complexity and risk tolerance. For simple instances, native features may suffice. But for growing businesses with significant customizations, these solutions can transform NetSuite SOX compliance from a source of stress into a well-managed process.

Passing the Test: Preparing for and Navigating a SOX Audit

The goal of your NetSuite SOX compliance efforts is a smooth, successful audit. With the right preparation, you can turn this into a straightforward demonstration of your financial controls.

Auditors aren’t trying to trick you; they are looking for clear evidence that your internal controls are designed effectively and have been operating consistently. They will ask for:

- Documented policies and procedures for financial processes, access, and change management.

- Evidence of control operation, such as completed approval workflows and reconciliations.

- Comprehensive audit trails for all transactions and system changes.

- Proof of segregation of duties (SoD) to confirm no single individual has end-to-end control over transactions.

This is where NetSuite’s native tools are invaluable. Saved searches for compliance are one of your most powerful assets. You can build and schedule searches to continuously monitor key controls, such as identifying transactions that bypassed approval or users with SoD violations. This allows you to find and fix issues long before auditors arrive. Our NetSuite Advanced Reporting Complete Guide can help you maximize these capabilities.

NetSuite’s reporting capabilities allow you to generate custom reports to meet specific auditor requests, and its support for international audit file formats (SAF-T, GDPdU, IAF) streamlines data provision.

The key is demonstrating ongoing compliance. Regular monitoring and proactive issue resolution are far more effective than scrambling before an audit. This gives CEOs and CFOs the confidence to certify their financial reports, knowing the data is backed by robust, verifiable controls. We can also help align your forecasts with your audit-ready books through our NetSuite Budgeting and Planning services.

At Nuage, we help companies prepare for and steer SOX audits by structuring their NetSuite environment to make the process as smooth as possible.

Frequently Asked Questions about NetSuite SOX Compliance

How does NetSuite’s cloud nature affect SOX compliance?

NetSuite’s cloud infrastructure simplifies NetSuite SOX compliance through a shared responsibility model. Oracle manages the physical and network infrastructure security, proven by its SOC 1 Type 2, SOC 2 Type 2, and ISO 27001 certifications. This frees your team to focus on the application layer: configuring roles, managing user access, and implementing approval workflows. You build the controls inside the fortress that Oracle secures. The high uptime of NetSuite’s data centers also ensures continuous access to financial systems, which is critical for timely and accurate reporting.

Can you achieve SOX compliance in NetSuite without third-party tools?

Yes, but it depends on your complexity. NetSuite’s native role-based security, approval workflows, and audit trails can meet SOX requirements, especially for smaller companies with few customizations. However, as your business grows, the manual effort required for tasks like SoD conflict analysis and detailed change tracking becomes immense. Third-party tools automate these processes, providing a more efficient, reliable, and less stressful path to compliance by reducing audit prep time and minimizing risk. The question is not if you can do it manually, but whether the effort and risk are worth it for your organization.

What is the most critical first step for SOX compliance in a new NetSuite instance?

The most critical first step is to get your roles, permissions, and Segregation of Duties (SoD) framework right from day one. Getting this foundation wrong creates technical debt and compliance issues that are difficult to fix later.

- Define Roles: Map out the minimum necessary permissions for each job function. Resist the temptation to grant broad access.

- Analyze for SoD Conflicts: Before going live, identify and resolve conflicts where a single user could, for example, create a vendor and approve payments to them.

- Implement Approval Workflows: Ensure critical financial transactions (vendor bills, journal entries) are routed through an automated approval process from the start.

Our NetSuite Implementation Consultants emphasize this foundation because time spent here saves weeks of remediation work later. For more information, explore NetSuite’s comprehensive GRC capabilities and consider how they fit into your overall implementation strategy.

Conclusion

NetSuite SOX compliance doesn’t have to be an overwhelming burden. NetSuite’s cloud platform provides a strong foundation, from its externally audited infrastructure to native features for access control, audit trails, and financial management.

However, owning NetSuite is just the start. True compliance comes from how you configure and use the system—mastering Segregation of Duties, tracking customizations, and understanding their financial impact. While native tools are powerful, growing companies often find that third-party solutions are necessary to automate complex compliance tasks and reduce risk.

This is where Nuage comes in. With over 20 years in digital change, we understand that every company’s journey is unique. As your NetSuite Optimization Engine, we partner with you to understand your specific challenges and configure your environment to work for you, not against you.

Whether you’re implementing NetSuite or struggling with compliance in an existing instance, our teams in Manhattan Beach, Ponte Vedra, and Jacksonville are ready to help build your compliance fortress. This allows you to focus on growing your business instead of worrying about your next audit.

NetSuite SOX compliance is achievable and manageable. Let us help you get there. Optimize your NetSuite environment for SOX and beyond with Nuage, and find what your system can really do.

NetSuite Compliance Support

At Nuage, we help companies maintain compliance with NetSuite Optimization and proper controls. Our Strategic Advisory team can help you:

- Implement SOX controls in NetSuite

- Maintain audit trails

- Automate compliance reporting

- Ensure data security

Our Managed Services team provides ongoing compliance monitoring and 24/7 Support.

Related Resources

Not sure if your NetSuite is optimized? Take our free NetSuite Scorecard to get a personalized assessment.

Want to see how we’ve helped other companies? Check out our customer success stories.

Last Updated: January 4, 2026