NetSuite financial planning is a comprehensive solution that empowers businesses to steer the complexities of financial management with precision and agility. At its core, NetSuite financial planning integrates key tools and features such as budgeting, forecasting, and financial modeling to provide real-time insights and foster informed decision-making. Key points to know:

- Budgeting and forecasting: Craft accurate financial blueprints for future growth.

- Financial modeling: Analyze data to predict future business performance.

- Comprehensive reporting: Access clear, detailed financial reports to guide strategy.

NetSuite’s cloud-based structure improves efficiency, allowing widespread access to crucial financial data, thus facilitating better-informed decisions. For more information, visit our NetSuite page.

As Louis Balla, with over 15 years of experience in NetSuite financial planning and ERP solutions, I specialize in streamlining business processes and ensuring successful digital changes. Let’s dig deeper into how NetSuite financial planning can transform your company’s financial strategy.

NetSuite financial planning glossary:

– NetSuite ERP development

– NetSuite data analytics

– NetSuite order management

Understanding NetSuite Financial Planning

NetSuite financial planning is essential for creating a seamless process to manage your company’s finances. This involves budgeting, forecasting, and utilizing financial data to make informed decisions. Let’s break down these elements and see how they work together.

Budgeting

Budgeting in NetSuite allows you to set financial targets and track your progress. You can create detailed budgets for different departments, projects, or even specific items. This flexibility helps ensure that every part of your business is aligned with your financial goals. NetSuite also lets you import budgets through CSV files or copy existing ones, making it easy to update and manage your financial plans. For more information, you can visit NetSuite’s official site.

Forecasting

Forecasting with NetSuite gives you the ability to predict future financial performance based on current data. This is crucial for strategic planning. By using real-time financial data, you can create forecasts that reflect the latest business conditions. This helps in anticipating changes, managing risks, and seizing opportunities.

Financial Data and Reporting

NetSuite integrates financial data from across your organization, providing a single source of truth. This data is used to generate comprehensive reports that offer insights into your financial health. With NetSuite’s reporting capabilities, you can easily compare budgeted figures against actual performance, identify trends, and make adjustments where necessary.

Modeling Capabilities

NetSuite’s financial modeling capabilities enable you to simulate different business scenarios. This is useful for understanding the potential impact of various strategic decisions. Whether you’re considering a new product launch or a market expansion, modeling can help you weigh the pros and cons and make data-driven choices.

Approval Workflows

Approval workflows in NetSuite streamline the budgeting and forecasting processes. They ensure that all financial plans are reviewed and approved by the necessary stakeholders before implementation. This not only improves accountability but also ensures that everyone is on the same page.

Real-World Example

Imagine a company using NetSuite to manage its annual budget. The finance team creates a budget for each department and sets up approval workflows to ensure each budget is reviewed by the department head. Throughout the year, they use NetSuite’s forecasting tools to update their financial outlook based on actual performance. This allows them to adjust their strategies in real-time and stay on track to meet their financial goals.

In summary, NetSuite financial planning combines budgeting, forecasting, and financial modeling to provide a comprehensive financial management solution. By leveraging real-time data and streamlined workflows, businesses can make informed decisions and drive growth.

Key Features of NetSuite Financial Planning

NetSuite financial planning offers a robust set of features that help businesses streamline their financial processes. Let’s explore some key elements: data synchronization, compensation planning, headcount planning, cost planning, multiple budgets, and statistical accounts.

Data Synchronization

One of the standout features of NetSuite financial planning is the seamless data synchronization with NetSuite ERP. This ensures that your financial and operational data is always accurate and up-to-date. With automatic reflection of account structures and dimensions in your plans, budgets, and forecasts, you can confidently rely on the data for decision-making. This integration eliminates the need for manual data entry, reducing errors and saving time.

Compensation and Headcount Planning

Compensation planning and headcount planning are crucial for aligning workforce needs with organizational goals. NetSuite simplifies these processes by allowing you to plan for headcount, salaries, and other compensation elements. This ensures that your workforce strategies support your business objectives, helping you manage costs and optimize resources effectively.

Cost Planning

NetSuite’s cost planning capabilities enable businesses to connect operational assumptions with financial outcomes. By supporting a hierarchical planning process, NetSuite ensures that both corporate finance and individual business units are aligned. This flexibility allows for detailed cost analysis and planning, helping businesses manage expenses and improve financial performance.

Multiple Budgets

With the multiple budgets feature, NetSuite allows you to create various budgets for the same time period. This is particularly useful for businesses that need to manage different financial scenarios or track performance across multiple departments or projects. You can easily set up and manage these budgets, ensuring that you have a comprehensive view of your financial landscape.

Statistical Accounts

Statistical accounts in NetSuite provide a way to budget and track non-financial data, like headcount or square footage. This feature allows you to incorporate operational metrics into your financial planning, offering a more holistic view of your business performance. By comparing statistical accounts against financial data, you can gain deeper insights and make more informed decisions.

These features make NetSuite financial planning a powerful tool for businesses looking to optimize their financial processes. By leveraging these capabilities, companies can improve accuracy, improve visibility, and foster collaboration across their organization.

Next, we’ll explore the process of setting up budgets in NetSuite and how it can further streamline your financial planning efforts.

Setting Up Budgets in NetSuite

Creating budgets in NetSuite is a straightforward process that can significantly improve your financial planning. Let’s explore how you can efficiently set up budgets using various features available in NetSuite.

Budget Creation

In NetSuite, you can save estimates of income and expenses as budgets for financial planning. Each budget covers a year and allows you to enter amounts per account for each accounting period. You can tailor budgets to specific customers, projects, items, departments, or any combination of these criteria. If you’re using NetSuite OneWorld, you can also create budgets for subsidiaries, providing a global view of your financial strategy.

CSV Import

NetSuite offers the flexibility to import budgets from external systems using the CSV Import Assistant. This feature is particularly useful if you have existing budget data in spreadsheets. By importing this data, you can quickly set up your budgets without manually entering each figure, ensuring consistency and saving valuable time.

Copying Budgets

To streamline the budgeting process, NetSuite enables you to copy budgets from previous years or based on financial results. This feature is a time-saver, allowing you to build on past data and make necessary adjustments for the new budget period.

Multiple Budgets

The Multiple Budgets feature is ideal for businesses that need to manage different financial scenarios. You can create several budgets for the same time period and criteria, allowing for flexibility in financial planning. Whether you’re planning for best-case, worst-case, or other scenarios, this feature helps you keep track of various financial outcomes.

Subsidiary Budgets

For businesses operating in multiple regions, subsidiary budgets in NetSuite OneWorld are essential. You can choose to use the subsidiary’s base currency or the root parent subsidiary’s base currency for each budget. This flexibility ensures that your financial planning aligns with local and global business needs.

Budget Exchange Rates

NetSuite also allows you to set independent Budget Exchange Rates for secondary accounting books. This feature is beneficial for companies dealing with multiple currencies, ensuring that your budgets reflect accurate financial data across different regions.

By leveraging these budgeting capabilities, NetSuite helps businesses streamline their financial planning, improve accuracy, and improve visibility into their financial performance. Next, we’ll dig into advanced financial planning techniques that can further optimize your budgeting efforts.

Advanced Financial Planning Techniques

In finance, advanced planning techniques are essential for making informed decisions and staying ahead of the curve. With NetSuite, you have access to a suite of powerful tools that take your financial planning to the next level. Let’s explore some of these advanced techniques.

Scenario Planning

Scenario planning allows you to prepare for various financial situations by creating multiple ‘what if’ scenarios. This involves developing basic low, medium, and high models to anticipate different outcomes. For instance, a low scenario might focus on cost savings during challenging times, while a high scenario could explore opportunities for growth when demand surges. By preparing for these possibilities, businesses can adapt quickly to changing market conditions.

Example: United Exchange reclaimed three months of work annually by leveraging NetSuite Planning and Budgeting for scenario planning, enabling them to respond swiftly to market fluctuations.

Financial Modeling

Financial modeling is a crucial part of NetSuite financial planning. It involves creating representations of a company’s financial performance based on historical data and assumptions about the future. NetSuite’s predictive planning uses industry-specific statistical models to improve the accuracy of forecasts, helping businesses make data-driven decisions.

Variance Analysis

Variance analysis is the process of comparing actual financial outcomes to budgeted figures. It helps identify discrepancies and understand the reasons behind them. NetSuite’s robust reporting features make it easy to conduct variance analysis, providing insights into areas that need attention and enabling proactive adjustments.

Budget vs. Actual Reports

NetSuite allows you to generate Budget vs. Actual reports, which are essential for tracking financial performance against targets. These reports highlight variances and allow for a detailed examination of where the business stands financially. By customizing these reports, you can focus on specific areas like departmental spending or project costs, ensuring that your financial strategies remain aligned with your goals.

Statistical Accounts

Statistical accounts in NetSuite offer a unique way to incorporate non-financial data into your financial planning. For example, you can track headcount or other metrics that impact your financial performance. This data can be used in conjunction with financial figures to provide a more comprehensive view of your business operations.

Case Study: Apparel brand Marine Layer improved its demand planning by using NetSuite’s statistical accounts, allowing them to align inventory with sales forecasts more accurately.

By mastering these advanced financial planning techniques, businesses can improve their strategic planning capabilities, improve forecast accuracy, and make well-informed decisions. Up next, we’ll explore the benefits of NetSuite financial planning and how it can transform your financial processes.

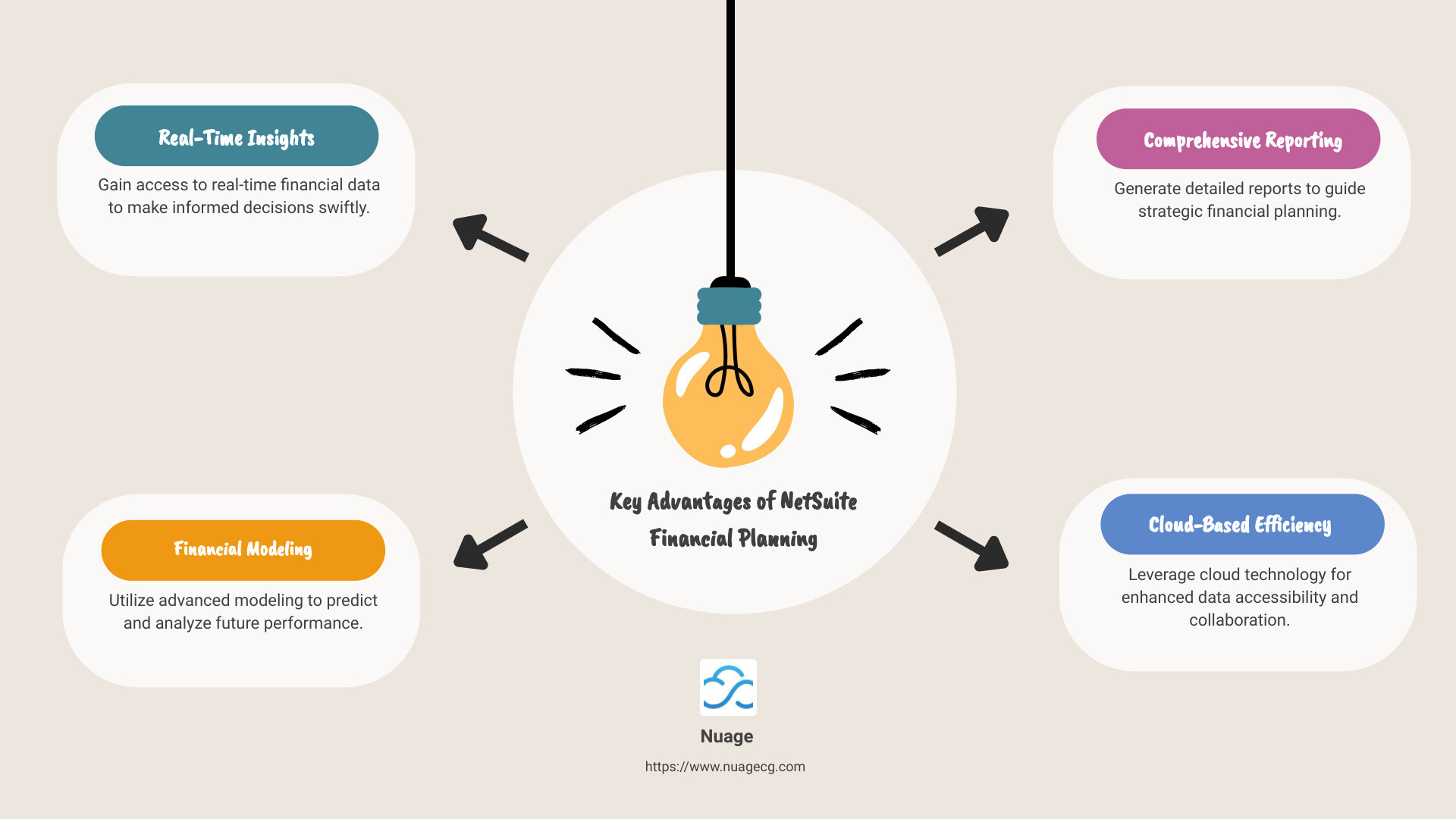

Benefits of NetSuite Financial Planning

Using NetSuite financial planning can transform how your company handles finances. Let’s explore the key benefits:

Streamlining Processes

NetSuite automates many financial tasks, reducing the need for manual data entry and spreadsheet management. This automation speeds up processes like budgeting, forecasting, and reporting. The result? Your team spends less time on repetitive tasks and more time on strategic planning.

Fact: NetSuite’s automation capabilities helped a family landscape business speed up budgeting and reduce accounts receivable by over $1 million.

Accuracy

With real-time data and automated processes, NetSuite minimizes the risk of human error in financial planning. It ensures that your financial reports are accurate and up-to-date, which is crucial for making informed business decisions.

Example: Depatie Fluid Power improved its forecasting accuracy with NetSuite Planning and Budgeting, leading to better business outcomes.

Visibility

NetSuite provides a clear view of your financial health by offering detailed insights into your company’s performance. Role-based dashboards and customizable reports allow you to access the information you need, when you need it. This visibility helps you stay on top of your financial metrics and make proactive adjustments.

Case Study: Marine Layer took its demand planning to the next level with NetSuite, gaining better visibility into sales forecasts and inventory levels.

Time-Saving

By automating tasks and providing real-time data, NetSuite saves your team valuable time. This efficiency allows your finance team to focus on analysis and strategy rather than data collection and entry.

Example: United Exchange reclaimed three months of work annually by leveraging NetSuite’s planning and budgeting capabilities.

Collaboration

NetSuite fosters collaboration by providing a single platform where all stakeholders can access and analyze financial data. This shared access boosts accountability and encourages teamwork, leading to more cohesive financial planning.

Quote: “We decided to switch to NetSuite because we wanted a system to support where the business was going.”

With these benefits, NetSuite financial planning not only improves the efficiency of your financial processes but also empowers your team to make better, data-driven decisions. Next, we’ll tackle some frequently asked questions about NetSuite financial planning to clear up any lingering doubts.

Frequently Asked Questions about NetSuite Financial Planning

What is the best FP&A tool for NetSuite?

When it comes to choosing the best Financial Planning & Analysis (FP&A) tool for NetSuite, integration and automation are key. NetSuite Planning and Budgeting stands out because it integrates seamlessly with NetSuite ERP, ensuring that all financial data is accurate and up-to-date. This tool eliminates the hassle of manual data entry and reduces errors, making financial planning smoother and more efficient.

The platform offers powerful features like revenue modeling, expense forecasting, and management reporting, which are crucial for effective financial planning. By automating these processes, NetSuite Planning and Budgeting allows your finance team to focus on analysis and strategic decision-making, rather than getting bogged down in manual tasks.

Does NetSuite have a forecasting tool?

Yes, NetSuite includes a robust forecasting tool as part of its financial planning suite. This tool leverages historical data and industry-specific statistical models to predict future trends and outcomes. The forecasting capabilities are designed to help businesses anticipate changes and make proactive decisions.

For example, businesses like Depatie Fluid Power have used NetSuite’s forecasting features to improve accuracy, resulting in better business performance. By using real-time data and predictive modeling, NetSuite helps organizations create more reliable forecasts and plan for the future with confidence.

What are the benefits of NetSuite planning and budgeting?

NetSuite planning and budgeting offers several key benefits that can transform your financial processes:

-

Accuracy: Automated data entry and real-time updates reduce the risk of errors, ensuring your financial reports are precise and reliable.

-

Efficiency: By streamlining budgeting and forecasting processes, NetSuite saves time and allows your team to focus on strategic tasks.

-

Visibility: Detailed dashboards and customizable reports provide a clear view of financial performance, enabling better decision-making.

-

Collaboration: A unified platform for financial data fosters teamwork and accountability, leading to more cohesive planning efforts.

-

Scalability: As your business grows, NetSuite can easily scale to accommodate new modules and users, making it a flexible choice for companies of all sizes.

These benefits make NetSuite a powerful tool for any organization looking to improve its financial planning and budgeting processes.

Conclusion

In today’s rapidly evolving digital landscape, navigating the complexities of ERP systems can be daunting. This is where Nuage shines. With over 20 years of experience in the ERP business, we have become trusted experts in digital change, particularly with NetSuite. Our deep understanding of both technology and business processes allows us to provide custom solutions that align with your company’s unique needs.

NetSuite financial planning offers a comprehensive suite of tools designed to streamline processes, improve accuracy, and improve visibility. However, maximizing these benefits requires more than just software; it requires a strategic approach to implementation and ongoing support. That’s where our expertise comes into play.

At Nuage, we don’t just help you select the right ERP solution; we partner with you throughout your entire digital change journey. From implementation to support, our team ensures that your transition to NetSuite is smooth and successful. We pride ourselves on our ability to adapt to the needs of diverse industries, including manufacturing and food and beverage, where we have a proven track record of driving growth and efficiency.

Our commitment to client satisfaction is unwavering. We understand that every business is unique, and we work closely with our clients to ensure that their ERP systems are not just functional but transformative. By choosing Nuage, you’re not just investing in software; you’re investing in a partnership that prioritizes your business goals and leverages the best of ERP technology.

Ready to take the next step in your digital change journey? Explore how our NetSuite consulting services can support your ERP needs and drive your business forward with confidence and success.