NetSuite budgeting and forecasting is a game-changer for businesses looking to transform financial planning into an automated, accurate, and proactive process. Here’s what you need to know:

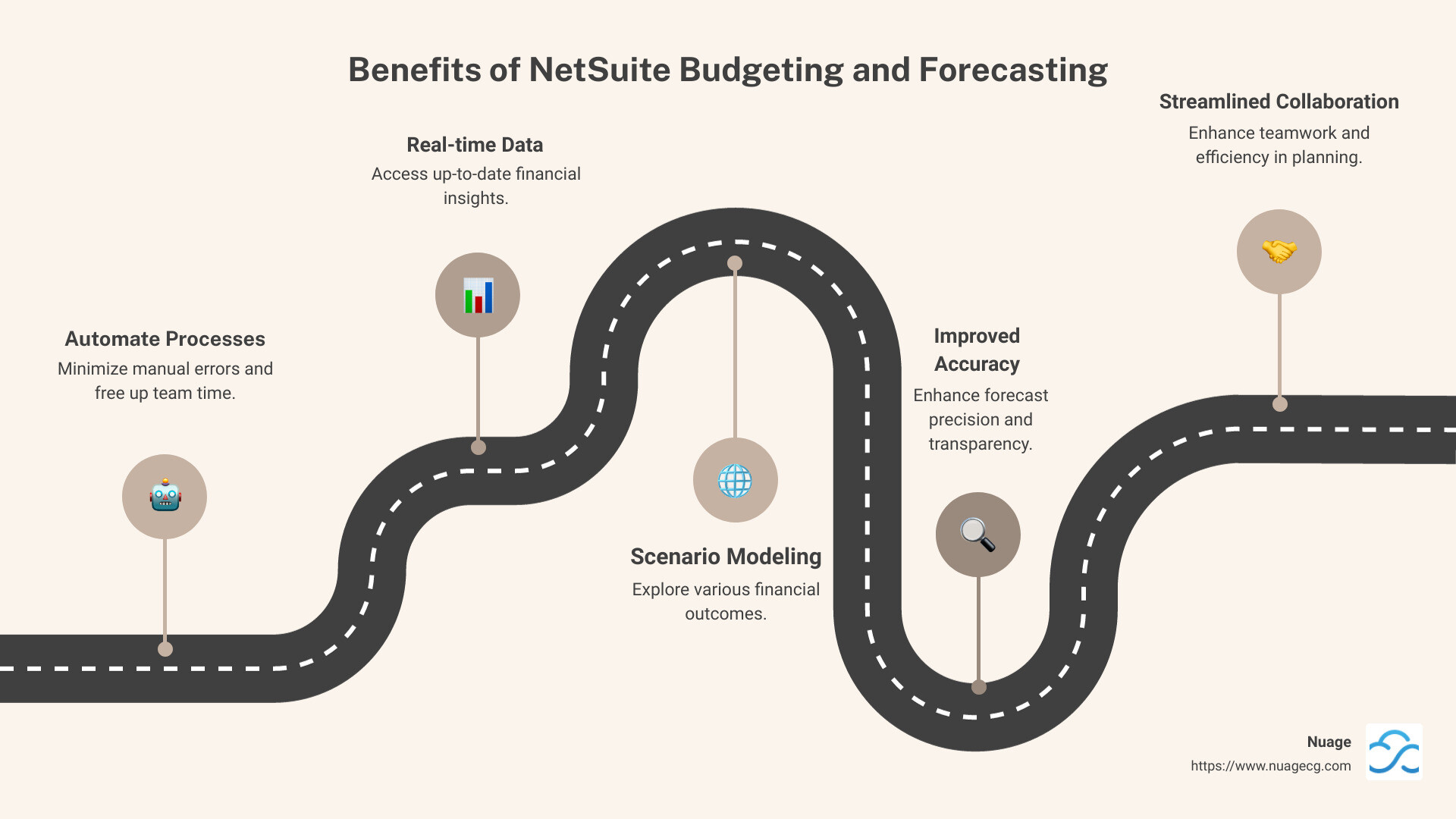

- Automate and Streamline: Automate routine processes, minimize manual errors, and free up your team’s time.

- Real-time Data: Access up-to-date financial insights for informed decision-making.

- Scenario Modeling: Explore various financial outcomes with versatile modeling tools.

In the evolving landscape of digital change, staying competitive means optimizing your financial operations. NetSuite helps you do just that by offering a comprehensive solution for financial planning and budgeting that adapts as your business grows.

I’m Louis Balla, an expert with over 15 years in digital change and specializing in NetSuite budgeting and forecasting. My experience ensures that you get the most out of your ERP investment by leveraging the full potential of automated financial management systems.

For more on how NetSuite can revolutionize your financial planning and boost efficiency, check out our comprehensive guide.

Understanding NetSuite Budgeting and Forecasting

Key Features of NetSuite

NetSuite Planning and Budgeting offers a powerful suite of tools designed to transform how businesses manage their finances. From automating routine tasks to providing real-time insights, NetSuite is the go-to solution for modern financial management.

Financial Management and Automation

NetSuite’s financial management capabilities allow businesses to automate and streamline their budgeting processes. This reduces errors and frees up valuable time for finance teams. By integrating financial data across departments, NetSuite ensures that everyone is on the same page, which improves collaboration and decision-making.

Workforce Planning

Managing your workforce effectively is crucial for achieving organizational goals. NetSuite’s workforce planning module aligns your staffing needs with business priorities. It helps plan for headcount, salaries, and compensation, ensuring your workforce strategy supports your company’s objectives.

Demand Forecasting

With demand forecasting, businesses can plan at multiple levels, such as customer, location, and item hierarchy. This feature allows for smarter buying and stocking decisions, ensuring that inventory levels meet actual demand. Real-time data from NetSuite facilitates the creation of accurate demand plans and purchase orders.

Scenario Modeling

NetSuite’s scenario modeling tools enable businesses to explore various financial outcomes. By modeling complex calculations, such as projected revenue and cash flow, companies can prepare for multiple scenarios without the risk of formula errors. This flexibility is essential for strategic planning and risk management.

Revenue Planning

Aligning revenue forecasts with corporate objectives is key to financial success. NetSuite’s revenue planning feature allows for driver-based forecasts, which integrate input from finance, sales, and service teams. This collaborative approach ensures that revenue targets are realistic and aligned with overall business goals.

OpEx Planning

Operational expenses (OpEx) can significantly impact a company’s bottom line. NetSuite’s OpEx planning connects operational assumptions with financial outcomes. Its hierarchical planning process enables both corporate finance and business units to contribute to a cohesive financial strategy.

Predictive Planning

Leveraging artificial intelligence, NetSuite’s predictive planning capabilities offer intelligent performance management. By analyzing plans, forecasts, and variances, the system uncovers trends and anomalies. This allows businesses to make data-driven decisions quickly and confidently.

Microsoft Office Integration

NetSuite seamlessly integrates with Microsoft Office, enabling users to work within familiar tools while benefiting from NetSuite’s robust financial planning capabilities. This integration streamlines workflows and improves productivity by allowing users to leverage their existing skills and resources.

By automating and optimizing financial processes, NetSuite budgeting and forecasting helps businesses stay competitive in an ever-changing market. For a deeper dive into how NetSuite can transform your financial operations, visit our main page.

Benefits of Automating Budgeting with NetSuite

NetSuite budgeting and forecasting revolutionizes how businesses approach financial planning. By automating these processes, companies can enjoy numerous advantages that streamline operations and improve decision-making.

Reduced Planning Cycle Times

One of the standout benefits of using NetSuite for budgeting is the significant reduction in planning cycle times. Traditional budgeting processes are often time-consuming and labor-intensive. With NetSuite, automation cuts down these cycles, allowing finance teams to develop budgets and forecasts more swiftly. This efficiency not only saves time but also enables quicker responses to market changes.

Accurate Information

Having access to accurate financial data is crucial for making informed decisions. NetSuite ensures data accuracy through real-time synchronization with its ERP system. This means that financial and operational data are always up-to-date and error-free. By eliminating manual data entry, NetSuite reduces the risk of human error, leading to more reliable financial reports.

Increased Transparency

Transparency is key to effective financial management. NetSuite provides a centralized platform where all stakeholders can access the same data, fostering a culture of openness and accountability. This increased transparency ensures that everyone involved in the budgeting process is on the same page, which improves trust and collaboration across departments.

Improved Forecast Accuracy

Forecasting is essential for anticipating future financial performance. NetSuite’s advanced predictive planning tools use artificial intelligence to analyze trends and variances. This leads to more accurate forecasts that better reflect potential future scenarios. Businesses can then allocate resources more effectively and plan for growth with confidence.

Streamlined Collaboration

NetSuite improves collaboration by bringing together finance teams and other departments in a single environment. This streamlined approach allows for easy data sharing and communication. Teams can work together seamlessly, contributing their insights and expertise to create comprehensive and cohesive financial plans.

By leveraging the power of NetSuite, businesses can transform their budgeting processes, leading to improved efficiency and better financial outcomes. For more insights into how NetSuite can benefit your organization, explore our main page.

How NetSuite Improves Financial Decision-Making

NetSuite budgeting and forecasting isn’t just about numbers—it’s about making smarter financial decisions. Here’s how NetSuite improves decision-making in your organization:

Real-Time Data

In today’s business world, having up-to-the-minute information is crucial. With NetSuite, you get real-time data that keeps you informed of the latest financial and operational metrics. This means you can make decisions based on the most current information, reducing the risk of relying on outdated or inaccurate data.

Variance Analysis

Variance analysis is a key tool in understanding the differences between planned and actual performance. NetSuite makes it easy to perform variance analysis by automatically comparing your budgets and forecasts against actual results. This helps you quickly identify discrepancies, understand their causes, and adjust strategies accordingly. By pinpointing what’s working and what isn’t, you can make more informed decisions.

Scenario Modeling

Imagine being able to explore different financial scenarios before making a decision. NetSuite’s scenario modeling feature allows you to do just that. You can simulate various “what-if” situations, such as changes in market conditions or shifts in consumer demand. This helps you anticipate potential challenges and opportunities, enabling you to plan proactively rather than reactively.

Reporting and Analytics

NetSuite offers robust reporting and analytics tools that provide deep insights into your financial data. With customizable reports and dashboards, you can visualize financial performance in ways that make sense for your business. Whether you need to track KPIs, analyze cash flow, or assess profitability, NetSuite’s analytics capabilities offer the clarity you need to make confident decisions.

By leveraging these powerful features, NetSuite empowers businesses to move beyond traditional budgeting and forecasting. It transforms financial data into actionable insights, driving smarter decision-making and ultimately leading to better business outcomes.

For more information on how NetSuite can transform your financial processes, visit our main page.

Frequently Asked Questions about NetSuite Budgeting and Forecasting

Does NetSuite do forecasting?

Absolutely! NetSuite offers a robust forecasting tool that leverages a probability system to improve accuracy. This tool allows you to project future financial outcomes based on historical data and trends. By utilizing real-time data, NetSuite can provide forecasts that reflect current market conditions, ensuring that your business decisions are based on the most up-to-date information. The forecasting capabilities are designed to help businesses anticipate changes and prepare accordingly, making it a critical component of strategic planning.

Does NetSuite do budgeting?

Yes, NetSuite excels in automated budgeting processes. It simplifies the creation of budgets by allowing you to model various what-if scenarios. This means you can explore different financial outcomes based on hypothetical changes in your business environment. NetSuite’s budgeting features also include the ability to generate detailed reports, which offer insights into expected revenues and expenses. By automating these processes, businesses can save time, reduce errors, and focus on strategic financial planning rather than manual data entry.

What is the difference between forecasting and budgeting?

While both forecasting and budgeting are essential financial planning tools, they serve different purposes. Budgeting involves setting a financial plan for a future period, typically outlining expected revenues and expenses. It acts as a roadmap for financial management, helping businesses allocate resources effectively.

On the other hand, financial forecasting focuses on predicting future financial outcomes based on current data and trends. It is more flexible than budgeting, allowing businesses to adjust their plans as new information becomes available. Forecasting helps organizations anticipate potential financial challenges and opportunities, enabling proactive decision-making.

In summary, budgeting sets your financial goals, while forecasting provides insights into how likely you are to achieve those goals. Both are integral to effective financial management and are seamlessly supported by NetSuite’s comprehensive tools.

For a deeper dive into how NetSuite can improve your budgeting and forecasting processes, explore our NetSuite page.

Conclusion

As we wrap up our exploration of NetSuite’s capabilities in budgeting and forecasting, it’s clear that digital change is more than just a buzzword—it’s a necessity for staying competitive. At Nuage, we understand that navigating this digital change requires expertise, and we are here to be your trusted partner.

With over 20 years in the ERP industry, our team is dedicated to helping businesses like yours select, implement, and support ERP solutions that truly fit your needs. Our partnership with NetSuite allows us to offer custom solutions that drive efficiency and growth.

NetSuite is not just a tool; it’s a comprehensive platform that improves financial planning through automation and integration. By leveraging its capabilities, you can reduce planning cycle times, improve forecast accuracy, and foster collaboration across your organization. This means you spend less time on manual data entry and more on strategic decision-making.

Why choose Nuage? Our deep understanding of ERP systems, combined with our commitment to your success, ensures that you get the most out of your digital investments. We don’t just implement software; we provide ongoing support and guidance to ensure your systems evolve as your business grows.

In a rapidly changing business landscape, having a reliable partner is crucial. Let us help you harness the power of NetSuite to transform your financial processes and drive your business forward.

Learn more about NetSuite through our main pages. Let’s start on this journey of digital change together.