Why Choosing the Right Accounting Platform Matters for Your Business

QuickBooks vs NetSuite is a critical decision for growing businesses. The choice boils down to a simple question: do you need a straightforward accounting tool or a comprehensive business management platform?

Quick Answer:

| Factor | QuickBooks | NetSuite |

|---|---|---|

| Best For | Small businesses, startups, freelancers | Mid-size to large enterprises, high-growth companies |

| Core Purpose | Bookkeeping and basic accounting | Full ERP with accounting, CRM, inventory, ecommerce |

| User Limit | Up to 25 users (Advanced plan) | Unlimited users (with per-user fees) |

| Complexity | Simple, easy to learn | Powerful but steeper learning curve |

| Scalability | Limited for complex operations | Built to scale with your business |

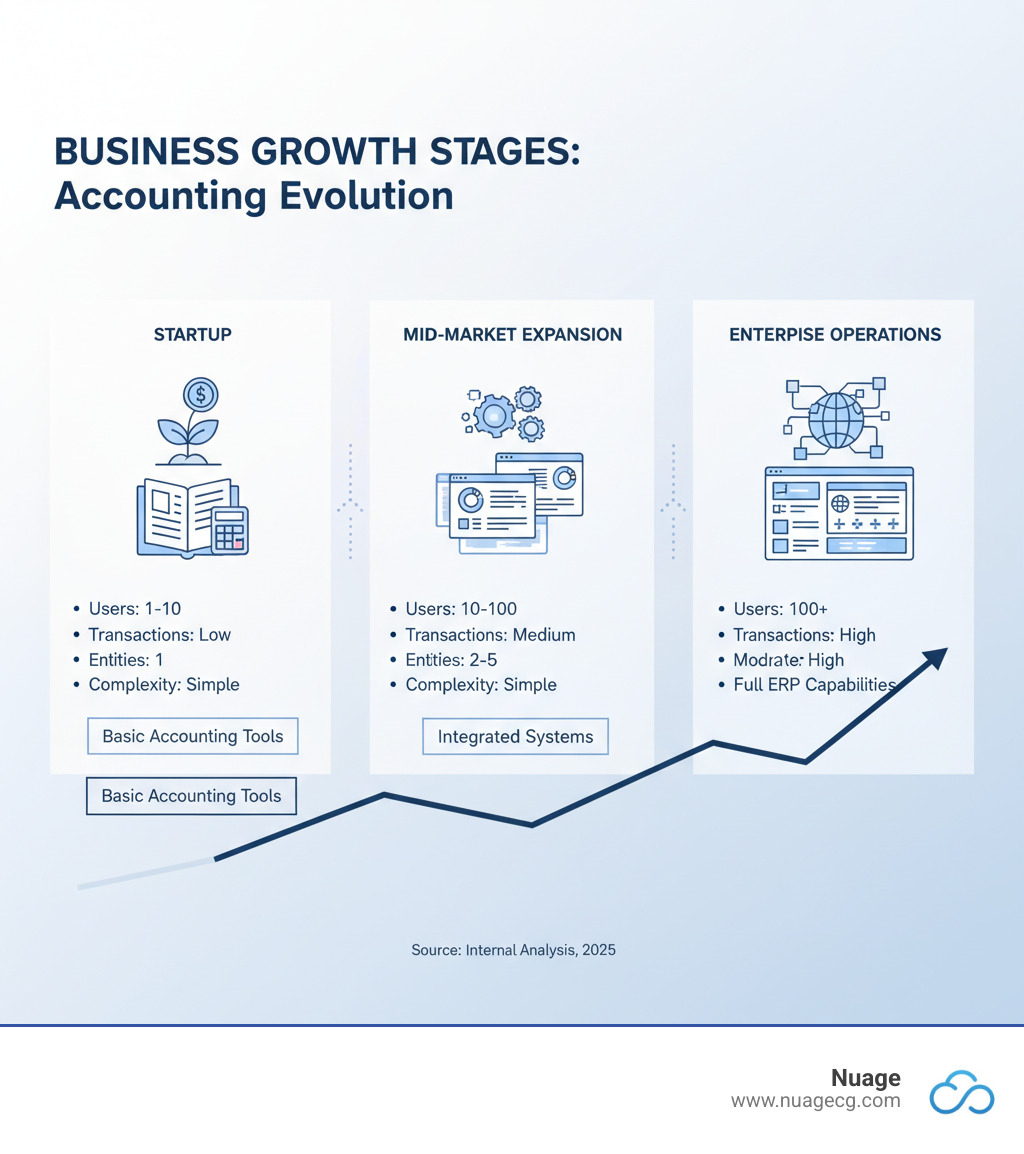

Many businesses start with QuickBooks, an easy, cost-effective solution. But as they grow, they often hit a wall, relying on spreadsheets and disconnected tools. Research shows 2 in 3 businesses feel underserved by small business tools but would be overserved by enterprise platforms. This is the gap where the QuickBooks vs. NetSuite decision becomes crucial.

QuickBooks dominates the small business market, while NetSuite, an Oracle-owned ERP, serves mid-market and enterprise companies needing integrated management. The question isn’t which is “better,” but which fits your business now and in the future. While 89% of customers said moving to NetSuite better supported their growth, it’s not the right choice for everyone.

I’m Louis Balla, CRO and partner at Nuage. With over 15 years of experience guiding this decision, I’ve seen how the right platform can accelerate growth, while the wrong one creates bottlenecks. This guide will help you make the right choice.

At a Glance: Target Audience and Core Functionality

The QuickBooks vs NetSuite conversation begins with understanding who each platform serves. One is a focused bookkeeping tool; the other is a comprehensive ERP platform that runs your entire company.

QuickBooks: The Go-To for Small Business Accounting

With roughly 80% of the small business accounting market, QuickBooks excels at its core promise. It’s designed for startups, freelancers, and small business owners who need straightforward financial management without a steep learning curve.

Its user-friendly interface makes it easy to manage invoices, track expenses, and prepare for tax season. Industries like construction and IT services rely on it for project costing and basic tracking. At its heart, QuickBooks handles the essentials: simple accounting, invoicing, and expense tracking.

NetSuite: The ERP Powerhouse for Scaling Enterprises

NetSuite is a complete business management suite designed for mid-size to large businesses and high-growth companies that have outgrown basic accounting tools. It’s the central command center for managing multiple locations, complex inventory, e-commerce, and sales teams.

The platform unifies advanced financials, ERP, CRM, and e-commerce into a single system. This eliminates data silos and manual reconciliation, providing real-time visibility across all departments. Its scalability means it grows with you, whether you’re adding users, expanding internationally, or launching new business lines. Companies in IT, computer software, and retail find this integrated approach invaluable. If you prefer a best-of-breed CRM, many organizations pair NetSuite ERP with Salesforce, the market-leading CRM.

Recognized by analysts like Gartner as a leader in cloud ERP, NetSuite provides the backbone for complex operations. It’s not just software—it’s the engine that runs your business. Exploring our NetSuite solutions can clarify how it centralizes business functions.

The True Cost: QuickBooks vs NetSuite Pricing Explained

When comparing quickbooks vs netsuite, pricing is a major consideration. However, these platforms represent different investment philosophies. QuickBooks is an operational expense, while NetSuite is a strategic investment in your business infrastructure. It’s crucial to consider the total cost of ownership (TCO)—including implementation, training, and the value gained from improved efficiency and real-time insights.

QuickBooks Pricing: Transparent and Accessible

QuickBooks is known for its transparent, straightforward pricing. You can visit their website and see the monthly subscription tiers, which scale from basic plans for freelancers to more advanced options for established small businesses. The low barrier to entry is a major draw. However, be aware that costs can increase with add-ons for payroll, payment processing, or advanced inventory, which are often necessary to fill functionality gaps. You can review current options on the QuickBooks Pricing w/ Discount page.

NetSuite Pricing: A Custom Investment for Growth

NetSuite pricing is customized and not publicly listed. The structure includes an annual license fee for the core platform, plus costs for optional modules (like CRM or advanced inventory) and per-user fees. This allows you to build a platform that fits your specific business needs.

Beyond the subscription, there is a significant one-time implementation investment. This fee covers setup, data migration, configuration, and training, and requires an experienced partner like Nuage to ensure success. While the upfront cost is higher, our clients consistently find that the ROI from operational efficiency, automation, and scalability makes it a worthwhile investment. The best way to understand the cost for your business is to get a custom NetSuite price quote.

Feature Deep Dive: Comparing Capabilities

When comparing quickbooks vs netsuite, the feature gap is significant. QuickBooks handles core accounting well, while NetSuite is built to manage your entire business operation. The question isn’t just about which has more features, but which features solve your business’s current and future problems.

| Feature Category | QuickBooks (Online Advanced / Enterprise) | NetSuite (ERP) |

|---|---|---|

| Core Accounting | General Ledger, AP/AR, Invoicing, Expense Tracking | All QuickBooks features, plus advanced GL, multi-book accounting, automated revenue recognition |

| Reporting & Analytics | Standard financial reports, customizable reports (Advanced) | Real-time dashboards, multi-dimensional reporting, custom analytics, drill-down capabilities |

| Inventory Management | Basic inventory tracking, FIFO/LIFO (Enterprise) | Advanced inventory, multi-location, warehouse management, demand planning, lot/serial tracking |

| Multi-Entity/Global | Separate subscriptions per entity, basic multi-currency | Consolidated financials across unlimited entities, advanced multi-currency, global tax compliance |

| CRM | Basic customer management, integrations | Fully integrated CRM (sales, service, marketing automation) |

| E-commerce | Integrations with platforms like Shopify | Native SuiteCommerce platform, integrated order management |

| Project Management | Project costing, time tracking | Project accounting, resource management, advanced billing, expense management |

| Business Process Automation | Rules-based automation (Advanced), third-party apps | Extensive workflow automation, approvals, system-wide integration |

Financial Management and Reporting

QuickBooks provides the essential financial statements any small business needs. But as you grow, you need deeper insights. NetSuite’s financial management offers real-time, multi-dimensional reporting, allowing you to analyze profitability by department, location, or product line without complex workarounds. For businesses with subscription billing or complex contracts, NetSuite’s advanced revenue recognition is automated and compliant, a task that requires manual spreadsheets in QuickBooks.

Inventory and Supply Chain Management

QuickBooks’ basic inventory tracking is sufficient for simple operations. However, it becomes a bottleneck when you manage multiple warehouses, need to track serial numbers, or deal with complex supply chains. NetSuite’s advanced inventory provides multi-location visibility, demand planning, and complete traceability with lot/serial tracking. It also handles complex calculations like landed costs automatically, giving you a true picture of product profitability.

Global Operations and Multi-Entity Management

This is where the difference is starkest. With QuickBooks, each legal entity requires a separate subscription, and consolidating financials is a manual, error-prone process. NetSuite was built for global, multi-entity businesses. It handles multi-subsidiary consolidation automatically in real-time, providing a single, unified view of your entire organization. Its advanced multi-currency and global tax compliance features are essential for any business expanding internationally. This level of control is a core benefit of our NetSuite solutions.

Scalability, User Experience, and Support

As your business grows, your software must scale with it. This is where the quickbooks vs netsuite comparison sharpens, highlighting the difference between a tool for starting and a platform for scaling.

The User Experience and Learning Curve

QuickBooks is famously easy to use. Its intuitive interface and gentle learning curve are invaluable for small business owners. NetSuite is undeniably more complex, but its power lies in its comprehensive nature. It uses role-based dashboards, so users only see the information relevant to their jobs. Once past the initial learning phase, teams often find the unified system more efficient than juggling multiple applications.

Integration and Scalability

QuickBooks relies on a third-party app marketplace for extended functionality. While flexible, this can lead to a patchwork of systems, data silos, and integration headaches as you grow. NetSuite’s approach is a unified platform where core modules like ERP, CRM, and e-commerce are built to work together seamlessly. This creates a single source of truth for the entire business.

This architectural difference is key for scalability. NetSuite is built to handle massive transaction volumes, unlimited users, and complex multi-entity operations. As evidence, 89% of customers said moving to NetSuite helped support their company’s growth more than QuickBooks.

Customer Support and Implementation

QuickBooks support is geared toward a DIY approach, with community forums and a knowledge base. Many businesses set it up themselves or with their accountant. NetSuite’s enterprise focus includes a more robust support model, often involving dedicated account managers and a network of implementation partners.

Implementing NetSuite is a strategic project, not a weekend task. It requires a partner-led process to map business processes, migrate data, and train your team. At Nuage, we specialize in this journey, ensuring the system is customized to your needs and that you get a real return on your investment.

Making the Choice: When to Stick vs. When to Switch

The quickbooks vs netsuite decision is about finding the right fit for your business stage. The challenge is that many growing companies find themselves in a gap: 2 in 3 businesses feel underserved by small business tools but overserved by enterprise platforms. The key is recognizing when your current system becomes a constraint.

Scenarios Where QuickBooks is the Right Fit

QuickBooks is an excellent choice for many businesses. Stick with it if you are a:

- Startup or small business with straightforward operations.

- Single-entity company operating in one primary location.

- Business with a limited budget that needs predictable, low operational costs.

- Company with basic reporting needs that relies on an external accountant who knows the platform.

Signs It’s Time to Graduate to NetSuite

Growth pains are the clearest indicator that it’s time to switch. Look for these signs:

- Over-reliance on spreadsheets: Are you constantly exporting data to Excel for reporting, consolidation, or analysis? This is a major red flag.

- Multiple entities or locations: If you’re managing separate QuickBooks files for each entity and manually consolidating financials, you’ve outgrown the system.

- Lack of real-time visibility: When departments work in data silos, decision-making suffers. A unified platform provides a single source of truth.

- Complex inventory or revenue: If you’re dealing with multiple warehouses, lot/serial tracking, landed costs, or subscription-based revenue recognition, you need a system built for that complexity.

A Note on the Future of QuickBooks Desktop

Intuit is clearly focusing its resources on the cloud. The company announced it will stop selling several Desktop versions to new U.S. subscribers after September 30th, 2024, and will discontinue support for older versions (as reported by firmofthefuture.com). For businesses on Desktop, this creates a natural decision point. You can move to QuickBooks Online, or, if you’re experiencing the growth pains above, it may be the perfect time to evaluate a true ERP like NetSuite.

Frequently Asked Questions about quickbooks vs netsuite

We guide businesses through the quickbooks vs netsuite decision daily. Here are answers to the most common questions we hear.

How much does NetSuite really cost?

NetSuite pricing is customized, so there’s no public price list. The investment includes an annual subscription (based on your core platform, selected modules, and user count) and a one-time implementation fee. The subscription often starts with core financials, with optional modules for CRM, inventory, and more. The implementation fee covers setup, data migration, and training, and is critical for success. While the initial investment is higher than QuickBooks, it’s a strategic platform built for ROI. The only way to know the cost for your business is to get a custom quote directly from NetSuite.

Can QuickBooks handle multiple companies?

Not effectively. QuickBooks requires a separate subscription for each legal entity. This means separate files and logins. Consolidating financials becomes a manual, error-prone process of exporting data to spreadsheets. This is a significant time drain and delays crucial financial insights. In contrast, NetSuite is designed for multi-entity management, providing real-time, automated consolidation in a single platform.

How long does it take to switch from QuickBooks to NetSuite?

A typical migration from QuickBooks to NetSuite takes 3 to 6 months. The exact timeline depends on your business complexity, the volume and cleanliness of your data, and the number of modules you’re deploying. It is a significant strategic project, not a simple software installation. Success depends on working with an experienced implementation partner like Nuage. With over 20 years of experience, we manage the entire process to ensure a smooth transition and long-term value from your investment.

Conclusion

Choosing between quickbooks vs netsuite is about aligning your software with your business trajectory. QuickBooks is an excellent tool for managing the finances of a small business, offering simplicity and affordability. NetSuite is a strategic platform for scaling a business, built to handle complexity and provide a unified view of your entire operation.

The decision to switch is driven by growth. When manual workarounds, disconnected systems, and spreadsheet-based reporting start holding you back, it’s time to consider a platform built for your future.

At Nuage, we’ve spent over 20 years helping businesses steer this exact transition. As a NetSuite Optimization Engine, we don’t just sell software; we partner with companies in Manhattan Beach, CA, Ponte Vedra, FL, and Jacksonville, FL, to select, implement, and support the right NetSuite environment for their unique needs.

If you’re seeing the signs of outgrowing your current system, it might be time for a conversation. We’re here to help you determine if NetSuite is the right next step. Explore what’s possible for your business on our NetSuite solutions page.