Why Salesforce Billing and NetSuite Integration is Critical for Modern Business

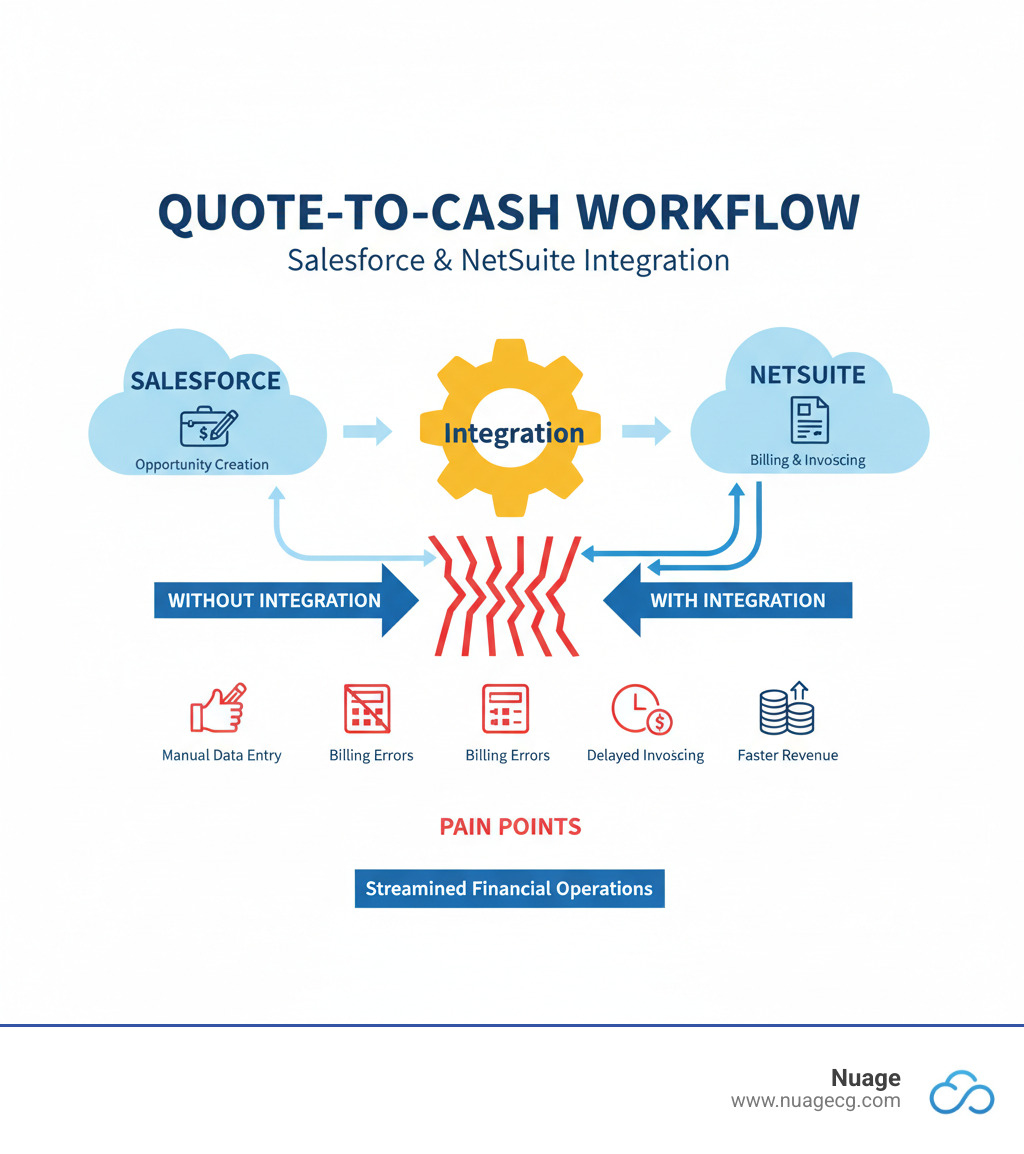

Salesforce billing and netsuite integration has become essential for businesses struggling with disconnected systems, manual data entry, and billing errors that cost time and money.

Quick Answer: Key Benefits of Salesforce Billing and NetSuite Integration

- Automated Quote-to-Cash Process – Eliminate manual data entry between systems

- Real-Time Data Sync – Keep customer and billing information current across platforms

- Unified Customer View – Access complete billing history and payment status in one place

- Reduced Revenue Leakage – Prevent billing errors and missed invoices through automation

- Faster Order Processing – Streamline from Salesforce opportunity to NetSuite invoice

Managing customer relationships in Salesforce while handling billing and financials in NetSuite creates data silos that hurt your business. Sales teams lack visibility into payment history. Finance teams struggle with incomplete customer data. Manual processes slow everything down.

The research shows that integrating NetSuite and Salesforce can reduce manual data entry by up to 80% and create a 25% faster order-to-cash cycle. Companies with integrated sales and finance systems report dramatically improved operational efficiency and better collaboration between teams.

I’m Louis Balla, and over my 15 years in digital change, I’ve helped countless businesses master salesforce billing and netsuite integration to streamline their quote-to-cash processes. Through my work at Nuage building third-party NetSuite applications, I’ve seen how proper integration transforms business operations.

Quick salesforce billing and netsuite integration definitions:

Why Integrate Salesforce and NetSuite for Billing?

Picture this: your sales team just closed a major deal in Salesforce, but your finance team is still waiting for someone to manually enter all the details into NetSuite. Meanwhile, the customer is wondering where their invoice is, and your cash flow is sitting in limbo. Sound familiar?

This is exactly why salesforce billing and netsuite integration has become essential for modern businesses. When your CRM and ERP systems work together seamlessly, magic happens. We’re talking about connecting two industry leaders hereSalesforce dominates the CRM space while NetSuite excels in financial management. But when they’re isolated from each other, even the best tools can create bottlenecks.

The change we see in businesses after integration is remarkable. Sales teams make smarter decisions with real-time financial data. Finance teams process orders without the usual back-and-forth emails. Most importantly, customers get faster, more accurate service. This isn’t just about saving timeit’s about fundamentally changing how your business operates.

Opening up Operational Efficiency

Let’s be honestnobody enjoys copying and pasting data between systems. Yet that’s exactly what happens without proper integration. Your team spends countless hours “swivel-chairing” between Salesforce and NetSuite, manually recreating information that already exists.

Salesforce billing and netsuite integration eliminates this tedious dance. When a deal closes in Salesforce, the integration automatically creates the corresponding sales order, billing account, and subscription in NetSuite. No human intervention required. Our data shows this reduces manual data entry by up to 80%imagine what your team could accomplish with all those hours back.

The ripple effects are impressive. Automated workflows mean faster order processing, often improving efficiency by 20-30%. Reduced manual tasks lead to fewer errors and happier employees. Faster order processing gets invoices out the door quickly, improving your cash flow. Most importantly, minimized revenue leakage ensures you’re not losing money to delayed or forgotten billing.

When your systems work together automatically, your team can focus on what humans do bestbuilding relationships, solving problems, and driving growth. That’s improved employee productivity in action.

Creating a Single Source of Truth

Nothing frustrates customers more than having to repeat their information to different departments. Without integration, your sales team might know about a customer’s recent purchase while your finance team is still working from outdated information. This disconnect creates confusion and erodes trust.

Unified customer view changes everything. With salesforce billing and netsuite integration, every team member sees the same complete picture. Sales reps can check payment history before making calls. Finance can access complete customer context when processing invoices. Support teams understand the full relationship history when resolving issues.

Real-time data synchronization keeps everyone on the same page. When a payment comes in, both systems update instantly. When a customer changes their billing address, it’s reflected everywhere immediately. This consistency enables improved reporting because you’re working with complete, accurate data across both platforms.

The result? Data-driven decisions based on reliable information and increased sales productivity of 10-15% because reps spend less time hunting for information and more time selling.

Fostering Sales and Finance Collaboration

Sales and finance teams often feel like they’re working for different companies. Sales focuses on closing deals while finance worries about getting paid. This natural tension gets worse when both teams are working from different, incomplete data sets.

Integration bridges this gap beautifully. Shared data visibility means sales teams can see inventory levels and payment terms directly in Salesforce. Finance teams get complete order details and customer context in NetSuite. Nobody has to guess or make assumptions anymore.

Reduced miscommunication naturally follows. When everyone sees the same information, there’s less room for confusion. Aligned departmental goals become possible because both teams understand how their work affects the complete customer lifecycle. Streamlined approval processes happen faster because approvers have all the context they need at their fingertips.

The 25% faster order-to-cash cycle we mentioned earlier? Much of that improvement comes from better collaboration between sales and finance teams who are finally working together instead of around each other.

Ready to explore how this could work for your business? Learn more about Salesforce solutions to see how we help optimize your sales processes. For the financial side, explore our NetSuite services to understand how we can streamline your operations. And to dive deep into NetSuite’s billing capabilities, check out the NetSuite SuiteBilling Overview.

Key Components of a Successful Salesforce Billing and NetSuite Integration

Building a successful salesforce billing and netsuite integration is like constructing a bridge between two busy cities. You need solid foundations, clear pathways, and systems that can handle heavy traffic in both directions. After helping countless businesses connect these powerful platforms, we’ve learned that the magic happens when you focus on the right components from the start.

The secret isn’t just about making two systems talk to each other—it’s about creating intelligent conversations that happen automatically, accurately, and reliably. This means getting your data mapping right, establishing robust bidirectional sync capabilities, leveraging the right API integration approaches, implementing smart middleware solutions, and building bulletproof error handling processes.

Think of Salesforce as your relationship expert and NetSuite as your financial wizard. When they work together seamlessly, your entire quote-to-cash process transforms from a series of manual handoffs into a smooth, automated journey that your teams will actually enjoy using.

Unifying the Quote-to-Cash Workflow

The quote-to-cash workflow is where salesforce billing and netsuite integration really proves its worth. We’ve seen businesses cut their order processing time in half simply by eliminating the manual steps between these systems.

Here’s how it typically works in practice. Your sales team uses Salesforce CPQ to configure complex products, calculate pricing, and generate professional quotes. Once that quote gets approved and becomes a Salesforce Order, the integration springs into action. Instead of someone manually recreating that order in NetSuite (with all the potential for typos and missed details), the system automatically creates the corresponding NetSuite Sales Orders with perfect accuracy.

But it doesn’t stop there. The integration continues the journey by generating NetSuite Invoices based on your billing schedules and terms. For subscription businesses, this is where things get really exciting—subscription management becomes completely automated. Whether you’re dealing with monthly SaaS billing, annual renewals, or complex usage-based pricing, the integration handles it all.

The beauty of automated invoicing is that it eliminates the delays and errors that used to plague the handoff between sales and finance. Your customers get their invoices faster, your cash flow improves, and your finance team can focus on strategic work instead of data entry. The Salesforce Platform handles the relationship and sales complexity while NetSuite manages the financial intricacies—each doing what they do best.

Achieving a 360-Degree Customer View

When we talk about a 360-degree customer view, we mean having all the pieces of the customer puzzle available to everyone who needs them. This is where salesforce billing and netsuite integration becomes truly transformative for customer relationships.

Imagine your sales rep is preparing for a call with a key account. Instead of switching between systems or making awkward phone calls to finance, they can see everything right in Salesforce. The complete customer data is there, including recent billing history, current payment status, any outstanding credit memos, and details about recent return management activities.

This complete visibility dramatically improves customer satisfaction because every conversation is informed and relevant. Your service team can quickly resolve billing questions because they have access to the full order and payment history. Your sales team can have confident conversations about renewals because they know exactly where the customer stands financially.

The integration ensures data accuracy across both systems, so there’s never confusion about which system has the “right” information. When a payment comes in through NetSuite, it’s immediately visible in Salesforce. When a customer updates their contact information in either system, it syncs everywhere. This unified view transforms how your entire organization interacts with customers.

Key Workflows in a Salesforce Billing and NetSuite Integration

The real power of salesforce billing and netsuite integration comes alive through specific workflows that automate your entire revenue process. These workflows eliminate the manual steps that slow down your business and create opportunities for errors.

The opportunity-to-invoice workflow is probably the most transformative. When your sales team marks an opportunity as “Closed-Won” in Salesforce, the integration automatically creates the customer record, billing account, and sales order in NetSuite. Depending on your billing terms, it can even generate the invoice immediately.

Quote-to-cash automation takes this a step further by connecting your Salesforce CPQ quotes directly to NetSuite’s billing engine. Complex pricing, product configurations, and discount structures flow seamlessly from quote to invoice without any manual intervention.

For subscription businesses, subscription creation and renewal workflows are game-changers. New subscriptions, upgrades, downgrades, and renewals managed in Salesforce automatically update the billing schedules in NetSuite, ensuring accurate recurring revenue management.

Order fulfillment sync keeps your operations team in the loop by ensuring that every Salesforce order appears as a NetSuite sales order with all the details needed for shipping and inventory management. Status updates flow back to Salesforce so your sales team always knows where their deals stand.

Finally, customer and product master sync ensures that fundamental data like contact information, addresses, product catalogs, and pricing stays consistent across both platforms. This foundation of accurate, synchronized data makes all the other workflows possible and reliable.

How to Implement Your Integration: A Step-by-Step Guide

Implementing a salesforce billing and netsuite integration might feel overwhelming at first, but with the right approach, it becomes an exciting journey toward operational excellence. Think of it like planning a major home renovation—you need a solid blueprint, the right tools, and experienced professionals to guide you through each phase.

Over our 20+ years in digital change at Nuage, we’ve guided countless businesses through this process. We’ve learned that success comes from careful planning, thoughtful execution, and keeping your team engaged throughout the journey.

Step 1: Define Your Goals and Integration Scope

Before we connect a single system, we need to get crystal clear on the “why” behind your integration. This foundation step determines everything that follows, and rushing through it is like building a house without checking if the ground is level first.

We start by diving deep into your business requirements. Are you drowning in manual data entry? Losing deals because billing takes too long? Struggling with disconnected customer information? Understanding your specific pain points helps us design an integration that actually solves your problems.

Next, we establish Key Performance Indicators (KPIs) that will measure our success. These might include reducing order processing time by 50%, cutting billing errors by 75%, or increasing sales team productivity by 25%. Having concrete numbers gives us something to celebrate when the integration goes live.

Process mapping comes next, and this is where things get interesting. We document your current quote-to-cash workflow, billing processes, and customer management procedures. It’s like creating a treasure map of your business operations—we mark all the bottlenecks, manual handoffs, and places where things typically go wrong.

The magic happens during stakeholder alignment. We bring together your sales, finance, and IT teams for collaborative sessions. Each department brings unique insights about daily workflows and pain points. Your sales team might reveal that they avoid certain deal types because billing is too complicated. Your finance team might share horror stories about chasing down missing order details. These conversations are gold for designing an integration that truly serves your business.

Finally, we define the integration scope with precision. Which data needs to sync between systems? What objects like opportunities, orders, invoices, and subscriptions are included? Should data flow one way or both directions? Clear scope management keeps the project focused and prevents that dreaded “scope creep” that can derail timelines and budgets.

Step 2: Choose Your Integration Method

Selecting the right integration approach is like choosing the right tool for a job—there’s no universal solution, but there’s definitely a best fit for your specific needs. Your choice depends on your requirements complexity, available resources, and long-term business goals.

Native connectors offer the simplest path forward. These pre-built solutions handle common integration scenarios with minimal setup. They’re perfect for straightforward workflows but might leave you wanting more flexibility if your business processes are unique or complex.

iPaaS solutions provide the sweet spot for many businesses. These cloud-based platforms give you the flexibility to handle complex, bidirectional data flows while offering powerful features like AI-driven error management and integration orchestration. They’re particularly valuable when you need to connect multiple systems beyond just Salesforce and NetSuite.

For businesses with highly specialized needs, custom API development offers unlimited flexibility. This approach requires significant technical expertise and investment, but it delivers exactly what your business needs without compromise. It’s like having a custom-custom suit versus buying off the rack.

At Nuage, we serve as your NetSuite Optimization Engine, focusing on finding the solution that best fits your unique business processes. We’re not here to sell you a particular software—we’re here to understand your needs and recommend the most effective integration strategy. Our insights on Why Middleware is Key for Salesforce and NetSuite Integration and our Salesforce NetSuite Connector by Nuage can help you understand how different approaches work in practice.

Step 3: Overcoming Common Salesforce Billing and NetSuite Integration Challenges

Even the best-planned integrations can hit bumps in the road. The good news? We’ve seen these challenges before and know exactly how to steer around them. Think of us as your experienced guides who know where all the potholes are hidden.

Data duplication is the classic integration headache that keeps finance teams awake at night. Without proper safeguards, you might end up with multiple customer records or duplicate transactions cluttering your systems. We prevent this nightmare by implementing robust de-duplication rules, establishing unique identifiers, and creating data validation processes during the mapping phase.

Sync conflicts arise when the same record gets updated in both Salesforce and NetSuite simultaneously. It’s like two people trying to edit the same document at once—chaos ensues. We solve this by defining clear conflict resolution rules upfront, specifying which system takes priority and how discrepancies get handled.

Data security becomes even more critical when sensitive customer and financial information flows between systems. We implement enterprise-grade encryption, strict access controls, and adhere to industry compliance standards to protect your valuable data. Your customers trust you with their information, and we help you honor that trust.

System customizations can throw curveballs into the integration process. Both Salesforce and NetSuite are highly customizable platforms, and your existing customizations might affect how data flows or fields map. We carefully analyze your current setup and adapt the integration logic to work seamlessly with your existing business processes.

User adoption often determines whether a technically perfect integration succeeds or fails in the real world. The most elegant solution is worthless if your team doesn’t accept it. We prioritize comprehensive user training and provide ongoing support to ensure your team feels confident using the new integrated workflows. We also focus on change management, helping your organization understand the benefits and adjust to new processes smoothly.

The key to overcoming these challenges lies in proactive planning, clear communication, and having experienced partners who’ve steered these waters before. With proper planning & strategy, solid data governance, thorough testing, careful deployment, and ongoing support, your salesforce billing and netsuite integration will deliver the efficiency and accuracy your business deserves.

Frequently Asked Questions about Salesforce and NetSuite Billing Integration

When we talk with businesses about salesforce billing and netsuite integration, the same thoughtful questions come up again and again. It’s natural—you want to understand exactly how this integration will change your daily operations and benefit your team. Let me share the answers to the questions we hear most often.

How does this integration improve collaboration between sales and finance?

This is honestly one of the most rewarding changes we see after implementation. The integration breaks down those invisible walls between departments that have frustrated teams for years.

Shared data access changes everything. Your sales team can finally see a customer’s payment history, outstanding invoices, and contract details right inside Salesforce—no more awkward calls to finance asking “Is this customer current on payments?” Meanwhile, your finance team gains visibility into closed opportunities, sales orders, and customer contact information directly in NetSuite.

The reduced friction is immediate. Gone are the days of manual data entry, endless email chains, and phone tag between departments. When both teams work from the same real-time information, misunderstandings disappear and processes speed up dramatically.

What we find most exciting is how this creates aligned goals. With a unified view of the customer journey from first contact to final payment, both sales and finance teams start understanding each other’s challenges and working toward shared revenue objectives. Faster approvals become the norm because sales deals include complete financial context, while accurate sales data streamlines financial reporting and revenue recognition.

The unified reporting capabilities give leadership something they’ve always wanted—a complete picture that spans both sales performance and financial outcomes. It’s like finally having all the puzzle pieces in one box.

What are the key workflows supported by the integration?

The beauty of salesforce billing and netsuite integration lies in how it transforms your entire quote-to-cash process into a seamless flow. Instead of thinking about individual tasks, you start seeing connected workflows that handle themselves.

Opportunity-to-invoice automation means that when your sales team marks an opportunity as closed-won in Salesforce, the integration immediately creates the corresponding sales order, billing account, and invoice in NetSuite. No waiting, no manual steps, no room for errors.

Subscription creation and management becomes effortless. New subscriptions, renewals, upgrades, and downgrades flow from Salesforce directly into NetSuite SuiteBilling for accurate recurring billing. Your customers get consistent service, and your finance team gets reliable revenue recognition.

Order fulfillment synchronization ensures that every Salesforce order appears correctly in NetSuite for inventory management and shipping. Order status updates flow back to Salesforce, keeping your sales team informed about delivery timelines.

The customer master sync and product and pricing sync workflows work quietly in the background, maintaining consistent information across both systems. Customer addresses, contact details, product catalogs, and pricing structures stay aligned automatically—crucial for accurate quoting and billing.

How does the integration impact return management?

Return management might not be the most glamorous part of business operations, but it’s where customer relationships are often won or lost. Salesforce billing and netsuite integration transforms this process from a potential headache into a smooth customer experience.

Service team visibility improves dramatically when customer service representatives can access a customer’s complete order and payment history from NetSuite while working in Salesforce. They can instantly verify purchase details, check warranty information, and confirm payment status without switching systems or making internal calls.

Having complete order and payment history at their fingertips means service reps can see exactly what was purchased, when it was delivered, and how it was paid for. This leads to faster, more accurate processing of return requests and fewer frustrated customers waiting for answers.

Faster credit processing happens automatically. When a return gets authorized in Salesforce, the integration can trigger the creation of credit memos or refund processes in NetSuite. This ensures timely financial adjustments and reduces the time customers wait for their money back.

The result is improved customer satisfaction that reinforces trust and loyalty. A transparent, efficient return process shows customers you stand behind your products and value their business. Plus, inventory levels update correctly in NetSuite, maintaining accurate stock counts for future sales.

These improvements might seem small individually, but together they create a customer experience that sets your business apart from competitors still struggling with disconnected systems.

Conclusion: From Integration to Change

Exploring salesforce billing and netsuite integration reveals something profound: this isn’t just about connecting software. It’s about changing how your entire organization operates, collaborates, and grows.

The strategic advantage of seamlessly connecting Salesforce and NetSuite extends far beyond data synchronization. We’ve seen businesses achieve remarkable operational efficiency, eliminate friction between sales and finance, and create a single source of truth that drives better decision-making.

Business growth becomes inevitable when your systems work in harmony. The 80% reduction in manual data entry we discussed isn’t just a time-saver—it’s human potential released. Your teams can focus on strategic initiatives and customer relationships instead of wrestling with spreadsheets.

Scalability is perhaps the most exciting benefit. As your business grows, an integrated salesforce billing and netsuite integration grows with you. The automated workflows we’ve outlined ensure your processes remain smooth and error-free, no matter the transaction volume.

At Nuage, we know true digital change isn’t about implementing the latest technology—it’s about finding solutions that fit your unique business needs. With over 20 years of experience in digital change, we’ve learned the most successful integrations feel natural and almost invisible to your day-to-day operations.

We’re not here to sell you software; we’re here to help you build a system that works. From our offices in Manhattan Beach, CA, and Ponte Vedra, FL, our team’s mission is to ensure your business stays ahead of modern commerce demands.

Don’t let disconnected systems cost another day of lost productivity or missed opportunities. The power of salesforce billing and netsuite integration is waiting to transform your quote-to-cash process into a competitive advantage.

Ready to take the next step? Read more on our Blog for additional insights into digital change strategies. When you’re ready to master your quote-to-cash process, Speak to an Expert to master your quote-to-cash process and find how Nuage can help you build the foundation for sustainable growth.