Why Manual Expense Reporting is Costing Your Business Time and Money

NetSuite expense reporting moves businesses from paper receipts and spreadsheet chaos to automated, policy-driven workflows. However, many companies still use manual processes that drain resources and create compliance headaches.

Quick Answer: NetSuite Expense Reporting Core Features

- Automated submission and approval workflows – Route reports through customizable approval chains

- Mobile receipt capture – Employees scan receipts on-the-go using OCR technology

- Policy enforcement – Automatically flag violations and enforce spending limits

- Real-time integration – Connect expenses directly to projects, GL accounts, and financial reporting

- Multi-currency support – Handle international expenses with automatic conversion

- Corporate card integration – Import and reconcile credit card transactions automatically

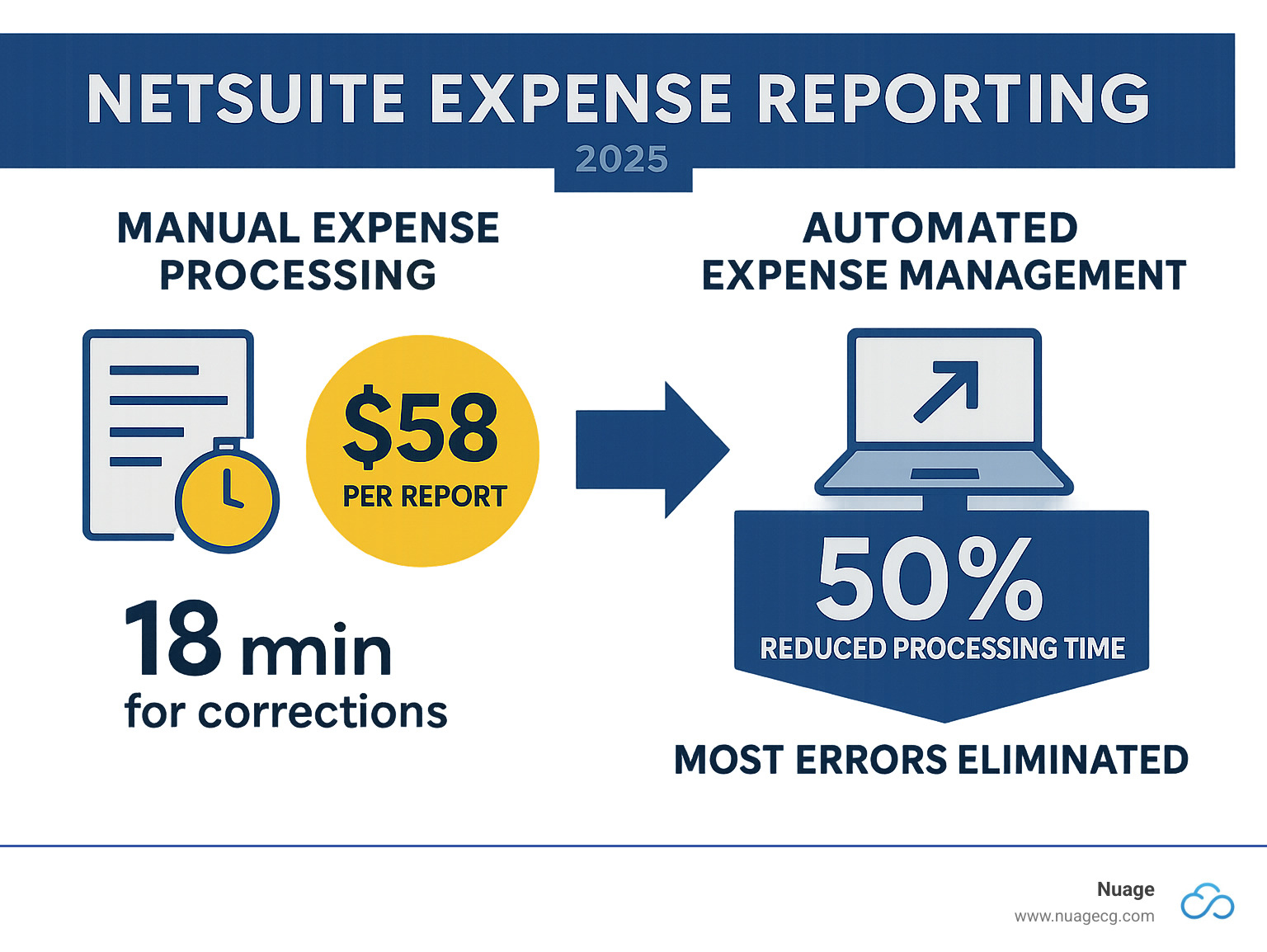

The numbers on manual expense management are stark. The Global Business Travel Association reports it costs an average of $58 to process one expense report and $52 to correct it. Since 20% of reports contain mistakes, companies lose significant money on a process that should be streamlined.

In a typical manual workflow, employees collect paper receipts, enter data into spreadsheets, email reports, and wait weeks for reimbursement. Finance teams then spend hours reconciling statements, chasing receipts, and manually coding expenses.

NetSuite’s expense management capabilities eliminate these pain points by automating the entire cycle from submission to reimbursement, integrating seamlessly with your financial processes.

I’m Louis Balla. With 15 years of experience optimizing NetSuite, I’ve seen how proper NetSuite expense reporting configuration saves businesses thousands of hours annually. My work with third-party integrations provides deep insight into the challenges teams face with expense management.

Key netsuite expense reporting vocabulary:

Why Ditch Spreadsheets? The Core Benefits of NetSuite Expense Management

If your team spends Monday mornings deciphering crumpled receipts and your finance department plays detective with missing documentation, you’re not alone. A surprising 33% of companies, including 38% of large enterprises, still use manual processes. This isn’t just inconvenient—it costs real money and time.

The math is sobering: it takes 20 minutes to complete one expense report and another 18 minutes to correct errors. The Global Business Travel Association reports costs of $58 to process and $52 to correct each report, a significant financial impact.

NetSuite expense reporting transforms how your organization handles expenses, making the process infinitely smoother and faster. Automation eliminates the tedious back-and-forth, creating a centralized system as the single source of truth for all expense data.

Key benefits include:

- Real-Time Visibility: Instantly see departmental expenditures, project costs, and budget adherence without waiting for month-end reports.

- Automated Policy Enforcement: Flag violations before they slip through. This is crucial, as 13.8% of fraud schemes involve expenses, and NetSuite’s controls help prevent these issues.

- Improved Accuracy: OCR technology for receipt scanning drastically reduces human error, catching mistakes before they impact your financial records.

- Faster Reimbursement: Efficient workflows mean your team gets their money back quickly, improving employee satisfaction.

NetSuite’s expense management capabilities integrate seamlessly with other financial modules. To understand how these pieces work together, explore our guide on NetSuite Finance Modules.

| Feature | Manual Expense Tracking (Spreadsheets/Paper) | NetSuite’s Automated System |

|---|---|---|

| Time per Report | ~20 minutes to complete, 18 minutes to correct | Significantly reduced via automation |

| Cost per Report | ~$58 to process, $52 to correct | Substantially lower through efficiency |

| Accuracy | Prone to human error, 20% reports have errors | High, due to automation and validation |

| Compliance | Difficult to enforce policies consistently | Automated policy enforcement, audit trails |

| Visibility | Lagging, fragmented data | Real-time, centralized insights |

| Fraud Risk | Higher, less oversight | Lower, automated flagging and audit trails |

| Employee Morale | Frustration, delayed reimbursements | Improved, faster and simpler process |

Gaining Control and Visibility

Implementing NetSuite expense reporting gives you immediate insight into where every dollar goes, who spent it, and why. This is about gaining strategic control over your company’s financial health.

- Sophisticated Spend Management: NetSuite’s categorization helps you identify major spending drivers and evaluate policies. Service companies can effortlessly tie expenses to specific projects, improving billing accuracy.

- Real-Time Budgetary Control: Approved expense reports automatically convert into bills that impact your books in real-time, ensuring only validated expenditures appear in your financial records.

- Seamless Project-Based Tracking: Expenses flow directly into project accounts, providing invaluable detail for accurate job costing and client billing.

- Complete Audit Trails: A detailed history shows who submitted what and when approvals occurred, providing essential documentation for internal controls and external audits.

For deeper insights into managing financial planning, our guide on NetSuite Budgeting and Forecasting shows how expense data flows into broader financial processes.

Enhancing Employee Experience

Expense reports are a dreaded task, but NetSuite expense reporting makes the process tolerable, even appreciated.

- Mobile Accessibility: Mobile access is a game-changer. Instead of collecting paper receipts, employees handle everything on their smartphones. On-the-go submission means capturing expenses immediately while details are fresh.

- Receipt Scanning (OCR): Employees snap a photo, and NetSuite’s intelligent system extracts key data, pre-populating the report and eliminating tedious data entry.

- Simplified Process: The intuitive mobile interface guides employees through each step, reducing a 20-minute task to just a few minutes.

- Quicker Reimbursement: Efficient approval workflows mean employees get their money back faster, improving morale and reducing inquiries to the finance team.

This improved experience boosts productivity. When employees aren’t bogged down by administrative tasks, they can focus on activities that drive business results.

A Step-by-Step Guide to Configuring NetSuite Expense Reporting

Properly configuring NetSuite expense reporting is foundational for smooth expense management. With over 20 years of experience in NetSuite ERP implementation, we know that a thoughtful setup pays long-term dividends. This guide is your roadmap from expense chaos to organized automation.

Enabling Features and Setting Permissions

First, you need to activate the feature and set permissions. Getting this right is key to a smooth rollout.

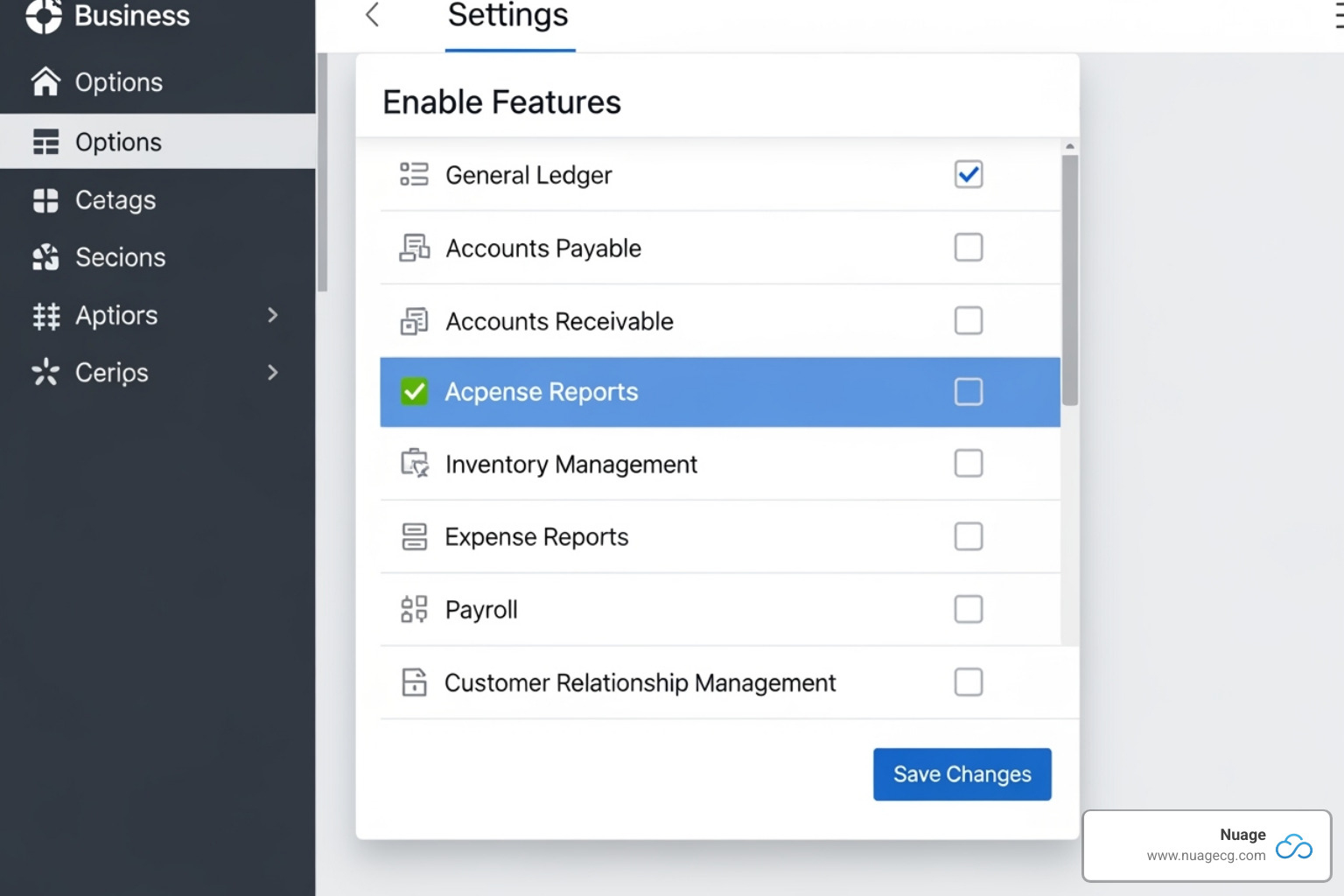

Steer to Setup > Company > Enable Features. Under the ‘Employees’ tab, check the ‘Expense Reports’ box to activate the core functionality.

Next, assign roles. The Employee Center role gives employees basic access to create and submit their own reports. Supervisor permissions should include the ability to review and approve team reports. Your accounting team needs broader permissions to review all approved reports, manage categories, and process payments. Setting these access levels correctly from the start prevents future headaches.

Creating and Utilizing Expense Categories

Expense categories are the filing cabinets of your system; thoughtful setup makes finding information effortless.

Go to Setup > Accounting > Setup Tasks > Expense Categories to create them. Think about how your business spends money, with common categories like travel, meals, software, and office supplies. Tailor the list to your specific business needs.

The key is to link each category to your GL accounts. This ensures that approved expenses automatically flow to the correct place in your financial records, eliminating manual coding. Well-organized categories make it easy to analyze spending patterns, which is valuable for NetSuite financial planning.

How to Create and Enforce Expense Report Policies

This is where NetSuite shines, turning static policies into active, automated budget guardians.

Create policies at Setup > Accounting > Expense Report Policies. First, define what you want to control, such as spending limits per meal, receipt requirements over $25, or specific approval workflows.

When creating a policy, define who it applies to, set spending limits, and determine how to handle policy violations. You can configure the system to warn users, block submissions, or alert supervisors. This automation ensures compliance with IRS tax-deductibility rules for business expenses and internal guidelines without constant manual oversight.

This proactive approach, combined with NetSuite’s flexibility for NetSuite ERP customization, ensures policies are followed, not forgotten.

The End-to-End Workflow: From Submission to Reimbursement

This is where NetSuite expense reporting shows its power, changing a receipt into a reimbursement. This seamless journey is why integrated ERPs are game-changers, eliminating the bottlenecks and confusion of manual processes. For a visual guide, see NetSuite’s NetSuite Expense Reports video.

For Employees: Creating and Submitting an Expense Report

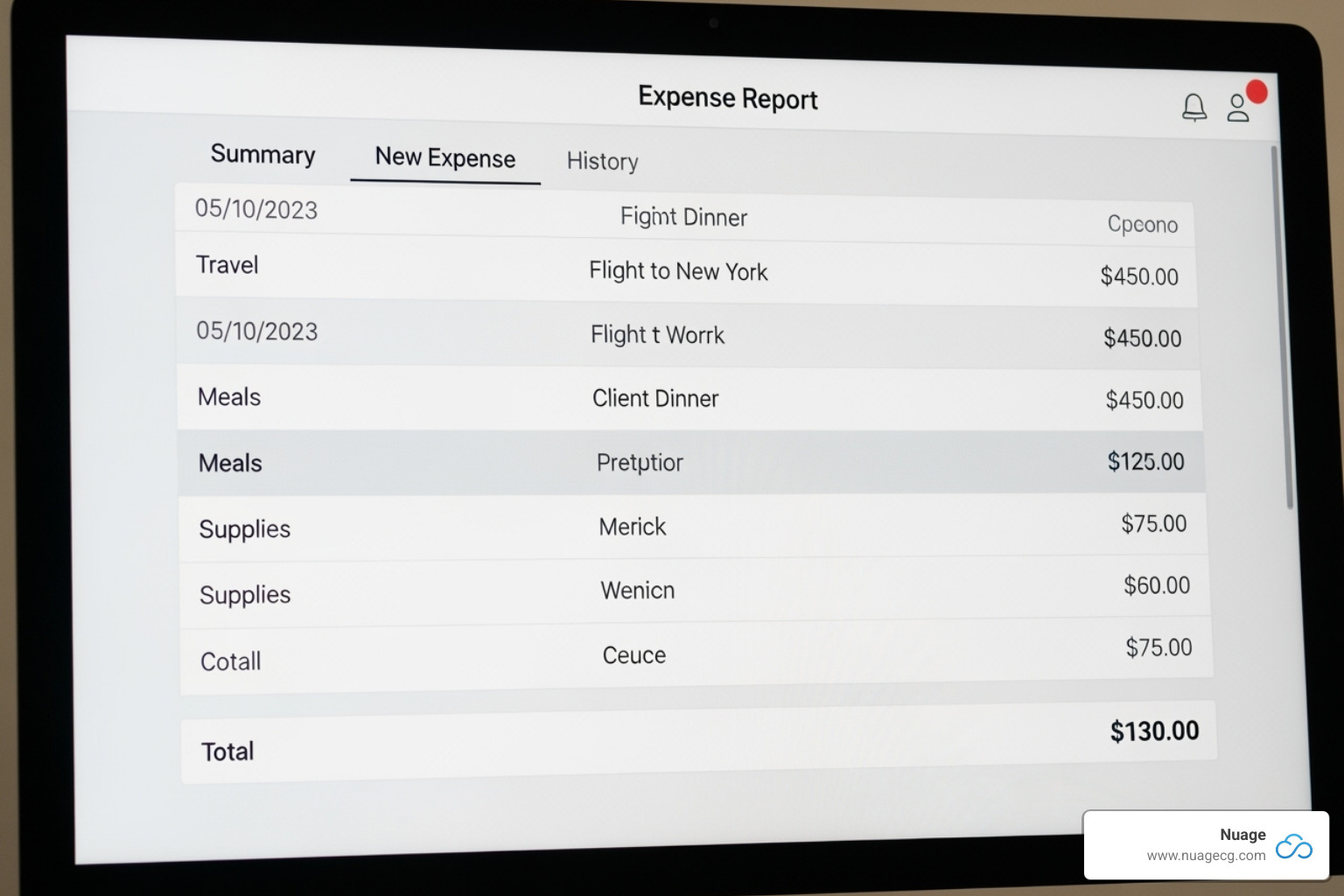

NetSuite makes submitting expense reports a painless experience. Employees can start a report via Transactions > Employees > Enter Expense Reports.

The system pre-populates employee information. Users add a date and purpose, then add individual expense lines. For each expense, they select a date, expense category, and enter the amount. NetSuite’s multi-currency features handle conversions automatically. The memo field adds context, and expenses can be marked as billable to a client or project.

The real magic is attaching receipts by snapping a photo with a phone. Upload the image or PDF directly to the expense line, eliminating the need to track paper. Corporate card charges can be marked as non-reimbursable to prevent duplicate payments.

Employees can save drafts and add expenses over several days. When complete, hitting Submit sends the report into the workflow. The system checks for policy violations first, and employees can track the report’s status in real-time.

For Managers: The Approval Workflow in Action

NetSuite’s intelligent workflow automatically routes each submission to the right person. Approval notifications arrive via email or the manager’s dashboard.

Managers see all line items, receipts, and policy warnings in one place, eliminating back-and-forth questions. They can approve with one click, moving the report to the next stage (usually accounting). If rejecting a report, managers can add detailed notes explaining what needs correction, providing clear, actionable feedback for the employee.

Once a supervisor approves the report, it automatically routes to accounting for final review and processing, where it converts into a bill against the company’s books.

For successful approvals, managers should:

- Review promptly to keep the reimbursement cycle moving.

- Verify receipts match expense details.

- Heed policy violation flags.

- Provide clear feedback on rejections.

- Consider the business context of each expense.

This automated workflow eliminates manual routing and paper sign-offs, resulting in faster processing and happier employees.

Frequently Asked Questions about NetSuite Expense Management

Here are answers to common questions about streamlining expense management with NetSuite expense reporting.

How does NetSuite handle corporate credit card expenses?

Managing corporate credit card spending can be complex, but NetSuite makes the process straightforward. It integrates with major card providers to automatically import transactions.

Employees can then easily match these transactions to their expense reports for streamlined reconciliation. The system clearly distinguishes between reimbursable and non-reimbursable expenses, ensuring accurate payments. For approved corporate card charges, NetSuite can also automatically generate vendor payments, smoothing out the accounts payable process.

Can NetSuite’s expense reporting integrate with other modules?

Yes. A key advantage of NetSuite is its tight integration. Unlike standalone tools, the expense reporting module connects seamlessly with other parts of your business system.

- Project Integration: Tie expenses directly to projects in NetSuite’s PSA module for accurate job costing and client billing.

- Accounts Payable: Approved reports flow automatically into AP, streamlining reimbursements.

- General Ledger: Expenses immediately hit the correct GL accounts, keeping your books current.

- Financial Reporting: All data appears instantly in dashboards, providing a complete, real-time view of spending and its impact on your bottom line.

What are the reporting and analytics capabilities for expenses?

NetSuite transforms expense data into business intelligence. Its reporting capabilities go beyond simple tracking to help you understand patterns and make smarter financial decisions.

You can create custom reports and dashboards to track expenses by category, department, or project. Drill-down capabilities let you investigate from a high-level summary down to individual transactions. Use trend analysis to forecast budgets more accurately and track policy compliance to refine your rules. These insights help you identify cost-saving opportunities by providing a clear view of where your money is going.

Open up Effortless Expense Management with Expert Guidance

The change to streamlined NetSuite expense reporting is more than a tech upgrade—it’s a reimagining of your expense process. It means an end to hunting for receipts, waiting for reimbursements, and manual reconciliation. The core benefits are clear: automation eliminates tedious work, control provides real-time visibility, and efficiency turns a 20-minute task into a two-minute mobile entry.

However, effective implementation is more than just enabling a feature. It requires thoughtful configuration, training, and optimization to match your business processes. The right partner makes all the difference.

At Nuage, we’ve spent over 20 years helping companies steer digital change. We understand every business is unique. As a dedicated NetSuite partner, we don’t just sell software; we design solutions that work for your team, changing expense management into a smooth, automated process.

Our approach is to be your NetSuite Optimization Engine. We go beyond implementation to ensure you’re leveraging every feature for a competitive advantage. Whether you have complex multi-currency needs, intricate workflows, or tight integration requirements, we know how to make it work seamlessly.

Ready to say goodbye to expense report headaches? Let’s work together to transform your NetSuite expense reporting into the streamlined system your business deserves. Contact us to master your NetSuite instance and find how much smoother your financial processes can become.

Last Updated: January 3, 2026

Looking for help optimizing your NetSuite? Contact our team for a free consultation.