The netsuite budget and planning tool is a transformative solution for businesses aiming to enhance their financial processes. By automating budgeting tasks, aligning financial goals, and minimizing manual errors, this tool is indispensable. It offers:

- Quick comparison of budget vs. actuals

- Improved scenario modeling and forecasts

- Better coordination among finance teams

In today’s business environment, having a reliable and efficient budgeting tool is critical. Organizations need accurate data and insights to make informed decisions. NetSuite stands out for its ability to provide these capabilities, making it a preferred choice for many. For more information, visit our NetSuite page or explore NetSuite’s official site.

I’m Louis Balla, with over 15 years of experience in digital change and supply chain management. I specialize in integrating solutions like the netsuite budget and planning tool. Let’s dive deeper into how these tools improve financial planning and strategizing for modern enterprises.

Netsuite budget and planning tool basics:

– financial planning and analysis

– netsuite planning and budgeting review

– netsuite planning and budgeting training

Understanding NetSuite’s Budgeting Tools

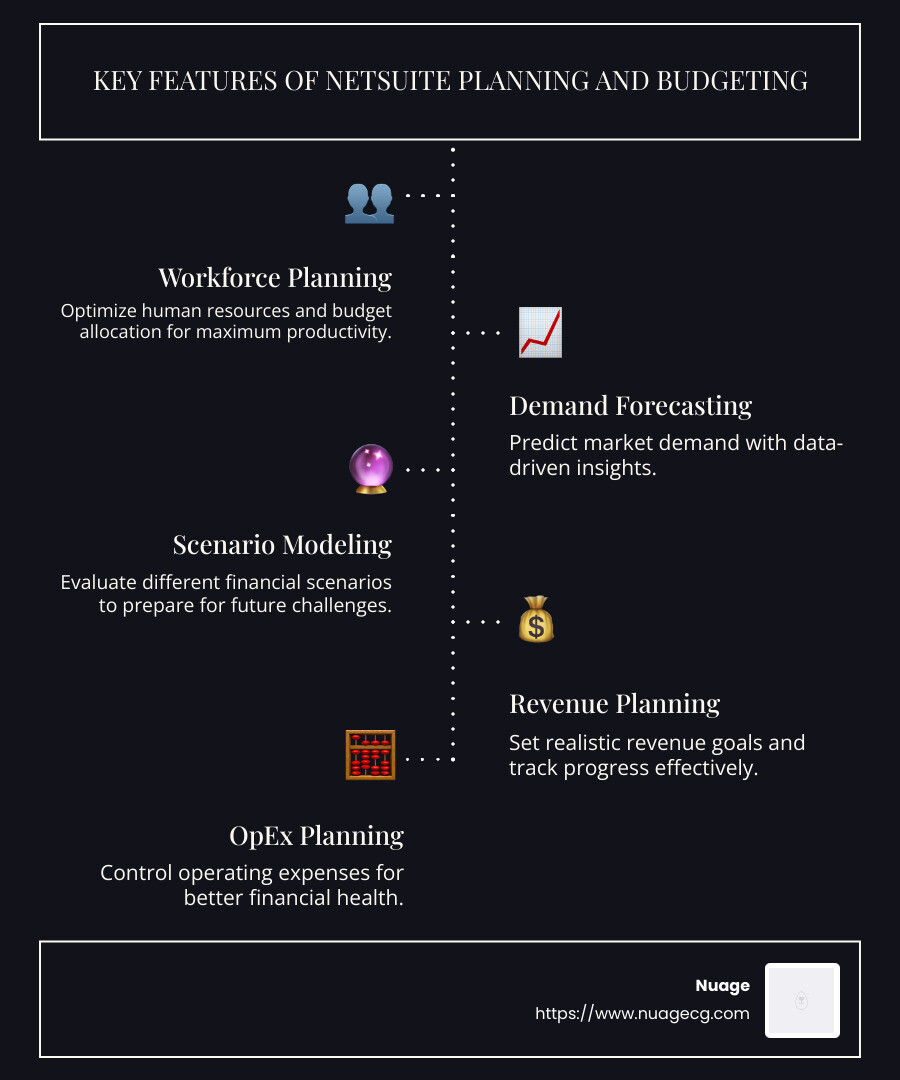

Key Features of NetSuite Planning and Budgeting

The NetSuite budget and planning tool is packed with features that help businesses automate and optimize their financial processes. Let’s explore some of these key features:

Automation

NetSuite automates the tedious aspects of budgeting and planning. Tasks like data consolidation, report generation, and troubleshooting are streamlined. This means finance teams spend less time on manual tasks and more time on analysis. This leads to better decision-making and financial positioning for the company.

Scenario Modeling

The tool excels in scenario modeling. Businesses can model different financial scenarios across multiple dimensions—like location, product, and customer. This helps in understanding the potential impact of different strategies without the risk of formula errors.

Financial Reports

NetSuite offers robust financial reporting capabilities. Users can generate detailed reports, including income statements and balance sheets. These reports integrate real-time data, helping businesses keep track of their financial health with ease.

Workforce Planning

Aligning workforce needs with organizational goals is crucial. NetSuite simplifies this process by helping businesses plan for headcount, salaries, and compensation. This ensures that workforce planning is efficient and aligned with company objectives.

Demand Forecasting

Demand forecasting allows businesses to plan at various levels, such as customer and location. This feature helps in creating demand plans and generating purchase orders. Smart demand forecasting leads to better buying and stocking decisions.

Revenue Planning

Aligning revenue forecasts with corporate objectives is seamless with NetSuite. Businesses can create revenue forecasts in collaboration with finance, sales, and service teams. This helps in monitoring actual performance against objectives and tracking cash flow impacts.

OpEx Planning

Operational Expenditure (OpEx) planning connects operational assumptions to financial outcomes. It supports hierarchical planning, which includes corporate finance and lines of business.

Predictive Planning

Leveraging AI, NetSuite’s predictive planning automates data analysis to uncover trends and anomalies. This feature speeds up decision-making and provides insights that would be hard to detect manually.

Prebuilt Data Integration

Seamless integration with NetSuite ERP ensures data accuracy. Financial and operational data sync automatically, keeping your plans and forecasts up-to-date.

Microsoft Office Integration

With Smart View, users can integrate NetSuite data with Microsoft Office tools like Excel and Word. This feature allows for on-the-fly data analysis and reporting using familiar tools.

These features make the netsuite budget and planning tool a comprehensive solution for businesses looking to improve their financial planning and budgeting processes.

Next, we’ll dig into the benefits of using NetSuite’s budgeting tools and how they can transform your financial operations.

Benefits of Using NetSuite Budget and Planning Tool

Reduced Planning Cycle Times

One of the standout benefits of the NetSuite budget and planning tool is its ability to significantly cut down planning cycle times. With pre-built templates and workflows, businesses can gather inputs and assumptions more efficiently. This faster process means companies can quickly adapt to market changes and make timely decisions. As one user noted, “NetSuite Planning and Budgeting helped us close our books 20% faster,” allowing for more agile business strategies.

Accurate Information

Accuracy in financial data is crucial for any organization. NetSuite ensures this by synchronizing data with its ERP system, providing real-time and reliable information. This eliminates the risks associated with manual data entry, ensuring that decisions are based on up-to-date and accurate data.

Increased Transparency

NetSuite’s budgeting tool improves transparency by standardizing processes and ensuring consistent data entry. This transparency builds trust among stakeholders and provides a clear audit trail for decision-making. Stakeholders can easily track changes and understand the rationale behind financial decisions.

Continuous comparisons between actual and projected results allow businesses to refine forecasts regularly. This leads to more accurate predictions and better resource allocation. For example, Depatie Fluid Power improved its forecasting capabilities with NetSuite, leading to improved financial performance.

Streamlined Collaboration

NetSuite connects all stakeholders in a single environment, making collaboration seamless. This unified platform encourages participation and accountability, allowing finance teams to gather meaningful input from operational managers efficiently.

Improved Scenario Modeling

Advanced scenario modeling capabilities allow businesses to evaluate the impacts of different strategies and decisions. This feature supports informed risk management and strategic planning, helping companies steer complex financial landscapes with confidence.

Reduced Reliance on IT

The intuitive interface and user-friendly features of NetSuite reduce the need for IT support in financial planning tasks. Finance teams can take control of their processes, making updates and adjustments without waiting for technical assistance. This empowers teams to focus on strategic analysis rather than getting bogged down by technical problems.

These benefits illustrate how the NetSuite budget and planning tool can transform your financial operations, making them more efficient, accurate, and collaborative. Next, we’ll explore how NetSuite Planning and Budgeting works to integrate seamlessly with your existing systems.

How NetSuite Planning and Budgeting Works

Integration with NetSuite ERP

NetSuite Planning and Budgeting seamlessly integrates with NetSuite ERP, ensuring a smooth flow of data and insights across your organization. This integration is key to open uping the full potential of your financial planning and budgeting processes.

Data Synchronization

One of the standout features of NetSuite is its robust data synchronization capabilities. By automatically syncing financial and operational data, NetSuite ensures that your planning and budgeting efforts are always based on the most current and accurate information. This reduces the need for manual data entry and minimizes errors, allowing your finance team to focus on strategic tasks.

Collaboration

NetSuite Planning and Budgeting fosters collaboration by connecting all stakeholders in a single, unified environment. This setup makes it easy for finance teams to gather input from various departments and operational managers. Increased accessibility and participation lead to more accurate and comprehensive financial plans.

Native Business Intelligence

With native business intelligence, NetSuite offers powerful real-time analytics directly within the system. Users can access critical business data and insights without switching between platforms. This integration helps teams understand their roles in the broader business strategy and make informed decisions quickly.

Real-time Analytics

Real-time analytics are at the heart of NetSuite’s value proposition. By providing up-to-the-minute insights into your financial performance, NetSuite enables businesses to react swiftly to market changes and make data-driven decisions. This capability is particularly beneficial for organizations looking to improve their agility and responsiveness.

Financial Statements and Variance Analysis

NetSuite’s integration with ERP allows for comprehensive financial reporting and variance analysis. Users can generate detailed financial statements that reflect real-time data, offering a clear picture of the company’s financial health. Variance analysis tools help identify discrepancies between budgeted and actual figures, enabling organizations to refine their strategies and improve forecast accuracy.

These features demonstrate how NetSuite Planning and Budgeting works hand-in-hand with NetSuite ERP to streamline your financial processes. The result is a more efficient, transparent, and collaborative approach to budgeting and planning.

Next, we’ll address some frequently asked questions about the netsuite budget and planning tool, including its automation capabilities and customization options.

Visit our NetSuite page for more information on how Nuage can assist with your NetSuite implementation and support needs.

Frequently Asked Questions about NetSuite Budget and Planning Tool

Does NetSuite have a budgeting tool?

Absolutely! NetSuite offers a robust budget and planning tool designed to simplify and automate financial processes. This tool is part of the NetSuite Planning and Budgeting suite, which enables finance teams to efficiently create budgets, forecasts, and financial reports. With automation at its core, it reduces manual data entry and errors, allowing teams to focus on strategic analysis.

The tool’s forecasting capabilities are particularly noteworthy. It allows businesses to compare budgeted figures with actual results swiftly. This feature helps in making informed decisions that improve financial performance. The automation embedded in the tool simplifies complex calculations and ensures accurate data consolidation, making budgeting a breeze.

Is NetSuite planning and budgeting worth it?

Yes, it is. The value of NetSuite Planning and Budgeting lies in its customization and extensive features. It offers advanced scenario modeling, workforce planning, and predictive planning, all within a user-friendly interface. These features make it adaptable to the unique needs of businesses, whether small or large.

The UI is intuitive, ensuring that users of all skill levels can steer the system with ease. This accessibility is crucial for organizations aiming to streamline their budgeting processes and improve collaboration across departments. The tool’s ability to integrate seamlessly with NetSuite ERP further improves its effectiveness, providing real-time analytics and comprehensive financial insights.

How much does NetSuite planning and budgeting cost?

While specific pricing details aren’t provided, NetSuite operates on a subscription model, which includes a base fee for the core platform. This model is flexible, allowing businesses to add optional modules custom to their needs. The cost also varies based on the number of users accessing the system, making it scalable for businesses of different sizes.

In addition to the subscription, there is a one-time implementation fee. This fee covers the initial setup and configuration of the system to meet your business’s specific requirements. This investment ensures that the tool is custom to your processes, maximizing its potential and return on investment.

For more detailed information about how NetSuite can benefit your business, visit our NetSuite page.

Conclusion

In this digital age, having the right tools and partners by your side is crucial. At Nuage, we understand the complexities of digital change and ERP implementation. With over 20 years of experience, we have honed our expertise in helping businesses steer the intricate world of ERP solutions like NetSuite.

Our approach is simple: we focus on your business goals and provide custom solutions that drive efficiency and growth. Whether you’re in manufacturing or the food and beverage industry, our team at Nuage is dedicated to ensuring a smooth transition and maximizing your return on investment.

Why choose Nuage?

- Comprehensive Services: From initial planning to post-go-live support, we cover every aspect of ERP implementation.

- Custom Solutions: We tailor our solutions to meet your specific business needs, ensuring you get the most out of your ERP system.

- Experienced Team: Our seasoned professionals bring a wealth of knowledge and experience to every project.

As your trusted partner in digital change, we are committed to helping you achieve operational excellence. If you’re ready to transform your business with NetSuite, visit our NetSuite page to learn more about how we can assist with your implementation and support needs.

Together, let’s harness the power of ERP technology and steer your business toward success.