Financial Planning and Analysis: Top 5 Essential Insights

Financial planning and analysis (FP&A) is crucial to understanding a company’s financial health and guiding its corporate strategy. As the backbone of a company’s strategic decisions, FP&A involves planning, budgeting, forecasting, and analysis, which together enable a company to maintain financial stability and foster growth.

- Forecasting: Predicting future financial outcomes based on current and historical data.

- Budgeting: Allocating resources effectively to meet strategic goals.

- Analysis: Evaluating financial data to support decision-making and improve profitability.

These activities help companies predict the impact of potential decisions on cash flow and profitability. They also allow for the creation of detailed financial models and forecasts, which are essential for strategic planning.

Financial Health

Maintaining financial health is a primary objective of FP&A. By monitoring and assessing a company’s financial status, FP&A teams ensure that businesses can pursue new opportunities and withstand economic fluctuations. This involves understanding financial statements, assessing financial ratios, and ensuring that the company can meet its short-term obligations.

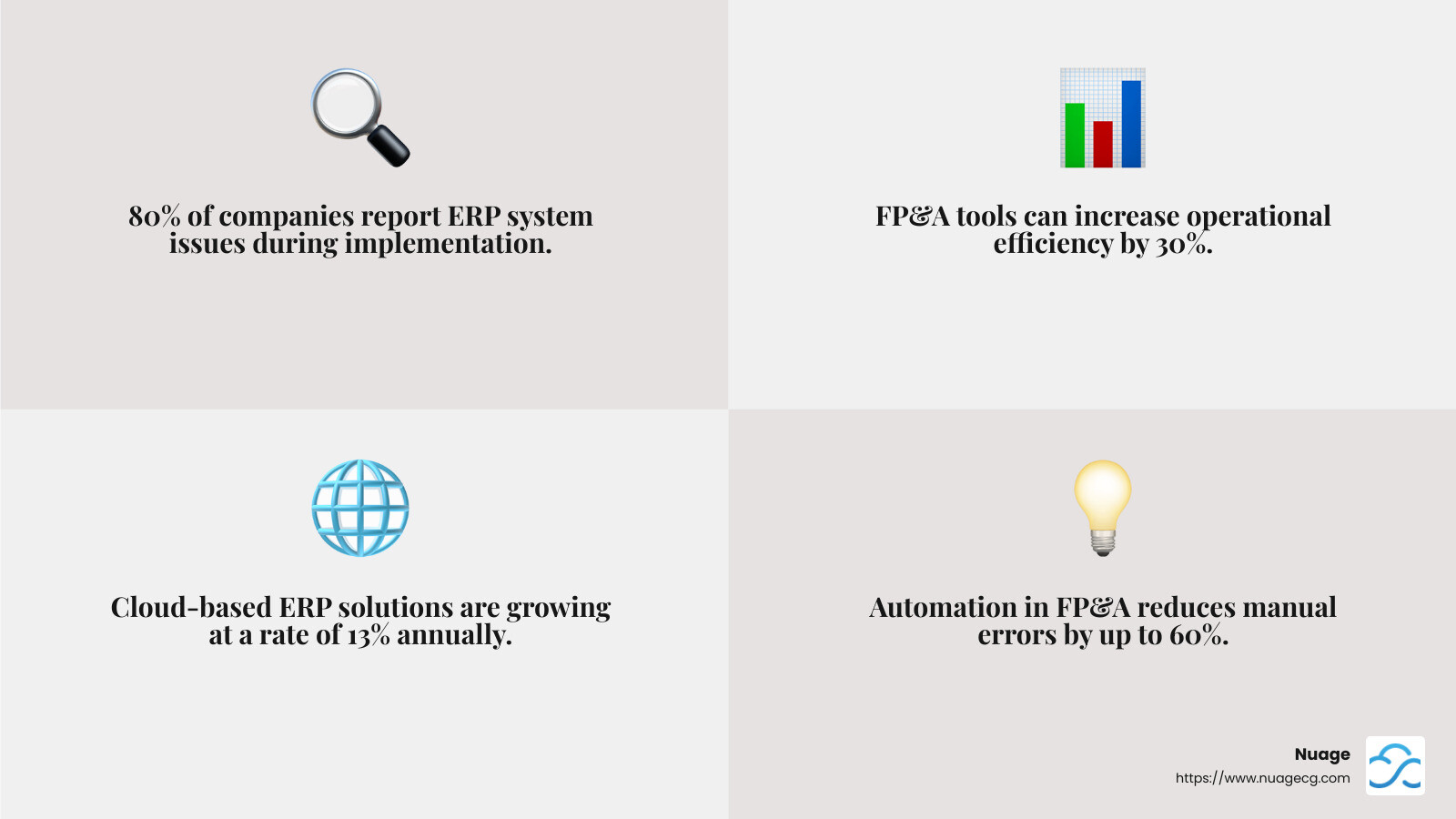

FP&A has evolved significantly with the advent of technology. Modern, cloud-based solutions like NetSuite have revolutionized FP&A by integrating artificial intelligence and automation. These tools improve the efficiency of FP&A processes, providing businesses with the agility needed to make swift and informed decisions.

In summary, financial planning and analysis is not just about crunching numbers. It’s about providing a strategic framework that supports a company’s growth and sustainability. By leveraging advanced technologies and methodologies, FP&A ensures that businesses remain competitive and financially sound in a rapidly changing world.

Key Components of FP&A

Financial planning and analysis (FP&A) is like the backbone of a company’s financial strategy. It involves several key components that keep the business on track and ready for anything. Let’s explore these components: planning, forecasting, budgeting, and analytics.

Planning

Planning is all about creating a roadmap for the company’s future. FP&A teams develop detailed financial plans that align with the company’s overall strategy. These plans lay out how to allocate resources effectively to meet business goals. For example, a company might plan to expand into a new market. The FP&A team would develop a financial plan to support this expansion, outlining necessary investments and expected returns.

Forecasting

Forecasting is like looking into a crystal ball, but with data. FP&A teams use historical data and current trends to predict future financial outcomes. This involves creating models to see how different scenarios could play out. For instance, what if sales increase by 10% next year? Forecasting helps answer questions like this, allowing companies to prepare for various possibilities.

Budgeting

Budgeting is about keeping spending in check. FP&A teams estimate the expenses needed to execute the corporate plan and allocate budgets to different departments. They ensure that each department has the resources it needs while preventing overspending. Many companies now use continuous budgeting cycles, with frequent updates to adapt to changing market conditions. This approach helps businesses stay agile and responsive.

Analytics

Analytics is the detective work of FP&A. It involves digging into financial data to uncover insights that can guide decision-making. FP&A teams analyze key performance indicators (KPIs) like sales, expenses, and profit margins. They translate these numbers into a narrative that helps decision-makers understand the financial situation and make informed choices. For example, analytics can reveal which products are most profitable or whether it’s more cost-effective to outsource production.

By focusing on these key components, FP&A teams provide the strategic insights needed to drive business success. They ensure that companies are not only planning for the future but also ready to adapt to whatever comes their way.

To enhance FP&A processes, modern tools and technologies like NetSuite and are making them more efficient and effective. These platforms offer comprehensive solutions that streamline financial planning, forecasting, budgeting, and analytics, empowering businesses to make data-driven decisions with confidence.

Modern FP&A Tools and Technologies

In today’s business world, financial planning and analysis (FP&A) is evolving rapidly, thanks to cutting-edge tools and technologies. These advancements are making FP&A processes faster, smarter, and more accurate, giving companies a significant edge over their competitors.

Cloud-Based Solutions

Gone are the days when FP&A software was limited to on-premise installations. Cloud-based solutions have taken center stage, offering numerous advantages. They allow teams to access data from anywhere, facilitating seamless collaboration and real-time updates. This is crucial for businesses that need to adapt quickly to changing market conditions.

Cloud platforms also connect to a wide array of Big Data sources, enhancing the depth and breadth of financial analysis. Security has improved significantly, often surpassing that of traditional on-premise systems. Companies like NetSuite offer robust cloud-based FP&A tools that integrate smoothly with existing business systems.

AI and Machine Learning

Artificial intelligence (AI) and machine learning are changing FP&A by automating complex data analysis tasks. These technologies help FP&A teams uncover hidden patterns, trends, and correlations in vast datasets that might otherwise go unnoticed. This leads to more accurate forecasts and better predictive analytics.

For instance, AI can boost multi-scenario planning by quickly generating multiple financial models based on different assumptions. Companies like Gelsenwasser are already leveraging AI for agile, real-time planning, and predictive maintenance, setting a new standard for FP&A capabilities.

Automation

Repetitive tasks like data sourcing, aggregation, and formatting can consume a lot of time for FP&A teams. Automation powered by AI and machine learning streamlines these processes, reducing errors and freeing up analysts to focus on more strategic work.

Robotic process automation (RPA) can handle everything from data collection to report generation, enabling FP&A teams to deliver insights faster. This shift allows team members to spend more time interpreting results and advising business leaders, enhancing their role as strategic partners.

By embracing these modern FP&A tools and technologies, businesses are better equipped to steer uncertainty and make informed decisions. As we dig deeper into the role of FP&A in corporate decision-making, we’ll see how these tools support CFOs and finance leaders in shaping strategic plans and financial models.

The Role of FP&A in Corporate Decision-Making

Financial planning and analysis (FP&A) plays a crucial role in shaping the strategic direction of a company. By providing essential support to the CFO and other executives, FP&A teams help guide important business decisions. Let’s explore how FP&A influences corporate strategy through strategic planning, financial modeling, and more.

CFO Support

The CFO relies heavily on FP&A for data-driven insights. These insights help answer critical questions about the company’s financial health and strategic direction. For instance, FP&A teams analyze current and historical data to forecast future revenues and expenses. This information is vital for the CFO when deciding whether to raise debt or equity financing or to invest in new projects.

FP&A also aids in risk management by running various scenarios to assess potential outcomes. This helps the CFO make informed decisions even in uncertain economic conditions. By leveraging robust software like NetSuite and , FP&A teams can provide real-time data and insights, enhancing the CFO’s ability to lead the organization strategically.

Strategic Planning

Strategic planning is at the heart of FP&A’s responsibilities. By linking financial and operational metrics, FP&A helps align the company’s goals with its financial capabilities. This is achieved through detailed analysis of market trends, competitor actions, and internal performance metrics.

For example, an industrial manufacturer might use FP&A insights to shift resources toward high-growth product lines, as evidenced by a case where a company achieved double-digit growth by reallocating resources based on FP&A recommendations. Such strategic shifts can lead to significant improvements in profitability and market positioning.

Financial Modeling

Financial modeling is another critical component of FP&A. It involves creating detailed financial scenarios to predict the impact of various strategic decisions. These models help answer specific “what-if” questions that are crucial for business planning. For example, what if the company hires more sales staff? How will this impact revenue and operational costs?

Financial models also assist in understanding the implications of potential acquisitions or divestitures. By modeling different scenarios, FP&A teams provide a roadmap for decision-makers, allowing them to visualize the financial impact of various choices.

Moreover, modern tools improve financial modeling by incorporating AI and machine learning, enabling FP&A teams to generate more accurate and dynamic models. This technology-driven approach helps companies stay agile and responsive to market changes.

In conclusion, financial planning and analysis is indispensable for corporate decision-making. By supporting the CFO, driving strategic planning, and developing comprehensive financial models, FP&A teams ensure that companies are well-equipped to steer the complexities of the business landscape. We’ll dig into some frequently asked questions about FP&A to further illuminate its vital role in business success.

Frequently Asked Questions about Financial Planning and Analysis

What does a financial planning and analysis team do?

A financial planning and analysis (FP&A) team is the backbone of a company’s strategic financial management. They engage in several key activities:

-

Planning: Crafting detailed financial plans that align with the company’s long-term goals. This involves collaborating with various departments to ensure all financial activities support the corporate strategy.

-

Forecasting: Predicting future revenues, expenses, and cash flows based on historical data and market trends. This helps the company anticipate financial needs and make informed decisions.

-

Budgeting: Developing budgets that allocate resources efficiently across the organization. This ensures that every dollar spent contributes to the company’s objectives.

-

Analysis: Evaluating financial data to identify trends, risks, and opportunities. This critical analysis supports decision-making at the highest levels of the company.

FP&A teams enable businesses to steer through uncertainties by providing a clear financial roadmap.

What is the highest salary in FP&A?

In FP&A, compensation varies based on experience, role, and the size of the company. Entry-level analysts can earn competitive salaries, but the real earning potential lies in senior roles:

-

Director of FP&A: This role typically commands a six-figure salary. Directors are responsible for overseeing the entire FP&A function, making strategic recommendations, and ensuring alignment with corporate goals.

-

Vice President (VP) of FP&A: As one of the highest-ranking positions, a VP can earn substantial compensation, often exceeding six figures. They play a pivotal role in shaping financial strategy and advising senior executives.

Compensation in FP&A is generally accompanied by performance-based bonuses, reflecting the critical role these professionals play in a company’s success.

How does FP&A differ from CFO responsibilities?

While both FP&A and the CFO are integral to a company’s financial health, their roles differ significantly:

-

Broader Scope: The CFO has a company-wide perspective, overseeing all financial operations, including accounting, compliance, and investor relations. They are involved in strategic partnerships and risk management.

-

Financial Oversight: FP&A focuses specifically on planning, forecasting, budgeting, and analysis. Their role is more forward-looking, concentrating on predicting future financial outcomes and advising on strategic decisions.

FP&A serves as a strategic partner to the CFO, providing the data and insights necessary for informed decision-making. The CFO, in turn, uses this information to guide the company through complex financial landscapes.

For more insights into how FP&A supports corporate strategy, explore our NetSuite solutions.

Next, we’ll explore how Nuage leverages these insights to drive digital change and improve ERP expertise.

Conclusion

At Nuage, we understand that financial planning and analysis is more than just a numbers game—it’s about steering businesses towards success in an changing digital landscape. With over 20 years of experience in ERP systems, we have positioned ourselves as a trusted partner in digital change, particularly for businesses in the manufacturing and food and beverage sectors.

Our expertise lies in helping companies select, implement, and support their ERP instances, ensuring that these systems evolve alongside your business. We don’t just sell software; we provide custom solutions that align with your strategic goals. Our partnerships with leading platforms like NetSuite and allow us to offer comprehensive tools that streamline operations, improve financial planning, and drive growth.

Digital change is not just about adopting new technologies—it’s about reshaping your business for the future. As the financial landscape continues to shift, leveraging advanced tools and methodologies becomes crucial. With our guidance, you can steer these changes with confidence, ensuring that your financial planning and analysis capabilities are robust and future-ready.

Explore how our NetSuite and solutions can transform your FP&A processes and empower your business to thrive in a constantly changing economy. Let’s start on this journey together, open uping new opportunities and driving strategic success.